Hi there,

Welcome to FinSoar! Amazon’s layoffs evidence a push to fund AI while trimming opex, the US–China truce flipped key trades across equities, metals, and rates, and beauty’s growth is splitting between AI-driven retail and a rising surgery economy.

Here’s what moved, why it matters, and what to watch next:

Amazon’s white-collar cuts: cost, AI, and what investors should watch

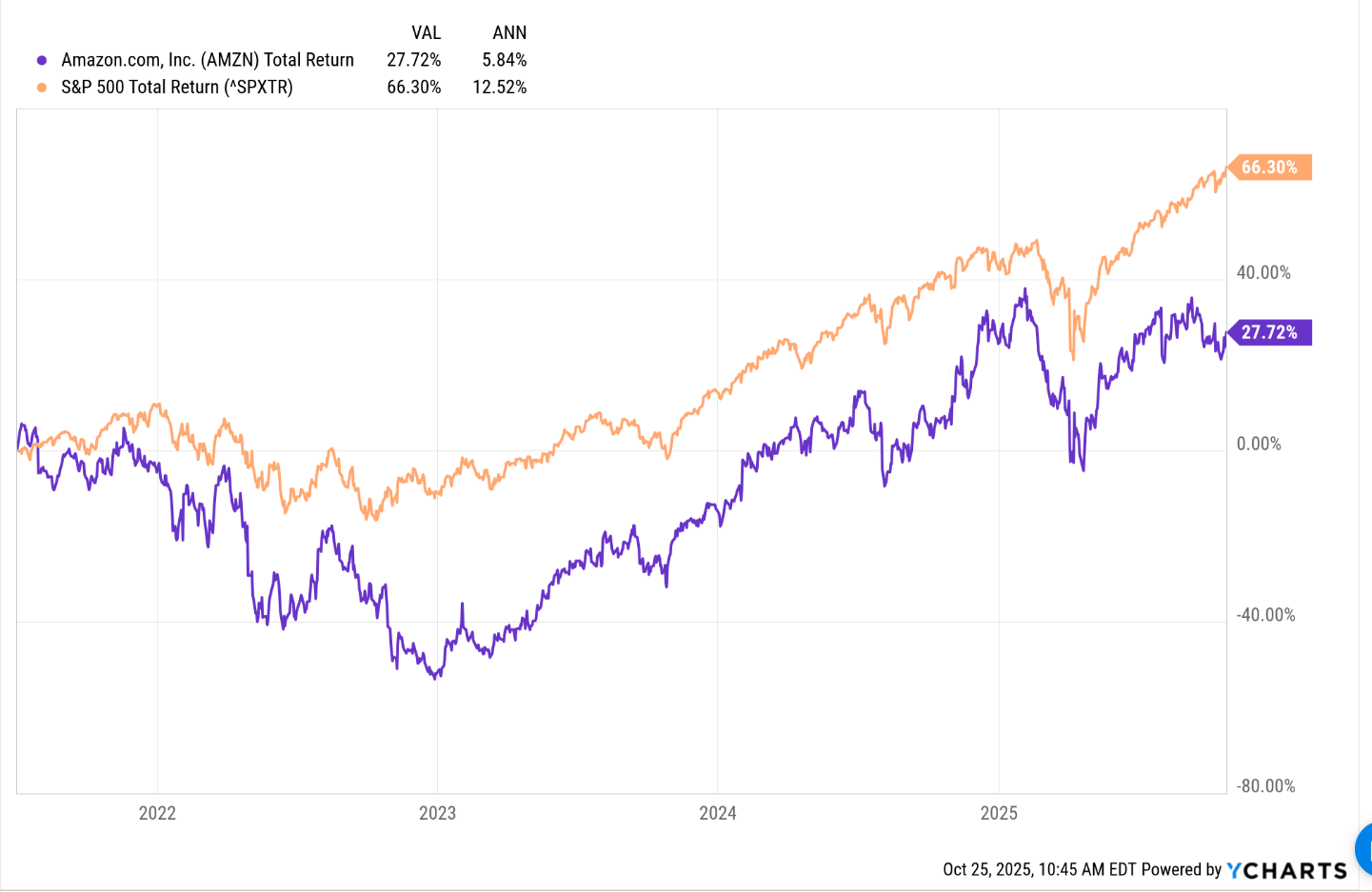

Amazon and S&P 500 total returns

Amazon confirmed plans to eliminate about 14,000 corporate roles, saying it needs a leaner structure to move faster on artificial intelligence and “biggest bets.”

The company framed the move as a reallocation instead of a retreat. Performance has been solid, but management argues AI is changing the pace of product cycles and the way work is done.

Press reports say the reductions could go further. Multiple outlets reported targets of up to 30,000 corporate jobs, or nearly 10% of Amazon’s roughly 350,000 corporate employees, with possible impacts across human resources, devices and services, operations, and AWS.

Amazon did not confirm that figure, but it did say more layering cuts and efficiency moves are likely as we move into 2026.

The headline message is familiar to anyone tracking big tech this year. AI adoption is allowing companies to do more with fewer people in certain functions, while hiring into new ones that support model development, infrastructure, and go-to-market.

Amazon’s CEO told staff in June that generative AI and agents would reduce some roles and create others. The firm reiterated that view this week and linked the reorg to speed and ownership rather than just cost control.

For investors, there are three lenses.

First, near-term operating expense.

Cutting several percent of the corporate base can add meaningful savings, even for a company at Amazon’s scale. Shares rose about 1.2% on the initial reports, a modest nod to margins and discipline.

Second, the ROI on AI capex.

Amazon is investing heavily in model development and cloud infrastructure while facing stiffer competition. AWS revenue growth has trailed Azure and Google Cloud in recent quarters, and any productivity boost from AI needs to translate into higher unit economics and stickier workloads.

Third, execution risk.

Reorganizations can slow delivery or dent morale even as they reduce layers. That matters heading into peak season, although Amazon still expects another large holiday and plans to hire 250,000 seasonal workers to support fulfillment and transport.

Amazon reports earnings this week. The key questions are simple. How much of the savings are incremental, how quickly do AI investments pull through to revenue, and does AWS close the growth gap with peers?

The answers will set the tone for the stock and for white-collar labor planning across big tech.

Sources: BBC, Reuters, The Guardian, Al Jazeera, CNBC,

Markets price a truce: what the US–China framework is doing to assets right now

A weekend framework between Washington and Beijing reset market risk. Equities hit records, havens sold off, and the “rare earths up, chips down” trade reversed.

First, stocks.

The S&P 500 closed above 6,800 for the first time, with the Nasdaq up 1.86% and the Dow up 0.7% after the truce headlines and a softer CPI print from Friday.

Investors leaned into semis, with Nvidia and peers higher, while rare-earth names slumped as supply-risk premia faded. That move had a clear driver.

US officials said the framework pauses the threatened 100% tariffs and would see China delay export controls on critical minerals for a year, pending leader-level sign-off later this week.

Pre-market and session data showed Critical Metals down ~18–21% with MP Materials and USA Rare Earth lower as well, as investors unwound “onshoring winners” tied to a prolonged standoff.

Second, havens and rates.

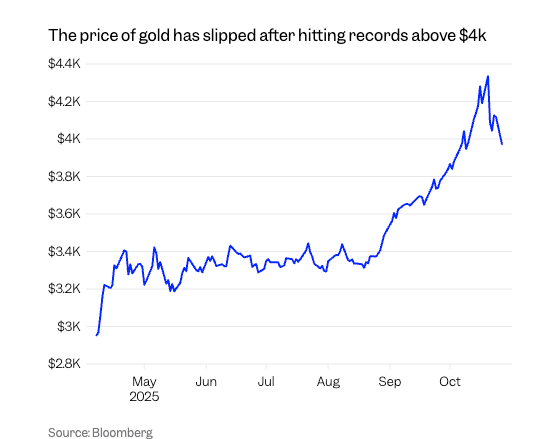

Gold fell below $4,000, extending last week’s drop, as safer assets lost their bid and traders took profits after an overbought surge. Spot was down about 3% intraday, with desks citing the truce headlines and a rally that had run too far, too fast.

The dollar index slipped, also on reduced safe-haven demand and carryover from softer inflation, while 10-year Treasury yields rose as investors rotated back into risk.

Third, the macro contours.

US officials said the framework will go to Presidents Trump and Xi this week and includes a tariff pause, a one-year delay on rare-earths curbs, and a plan for China to resume substantial US soybean purchases after September’s halt.

There was also progress flagged on shipping fees, fentanyl precursor enforcement, and a path to resolve TikTok access in the US, subject to internal approvals on both sides.

The near-term risk is headline volatility.

Strategists note the market is pricing a clean leader-level endorsement. Any back-tracking on tariffs or minerals could unwind Monday’s moves, particularly in semis, rare earths, and gold. For now, the tape says “risk on.” The longer view depends on whether this truce evolves into durable rules of the road, or another 90-day pause dressed up as peace.

Sources: Business Insider, The Guardian, Yahoo Finance / Barchart, Reuters, Fortune

The Beauty Economy’s Split Screen: AI, Access, and the New Business of Youth

Beauty is expanding at both ends of the spectrum: digitally and surgically.

On one side, AI and e-commerce are redefining how products are developed and sold. On the other, cosmetic surgery is moving downstream to younger, tech-savvy consumers chasing hyper-visibility in a filtered world.

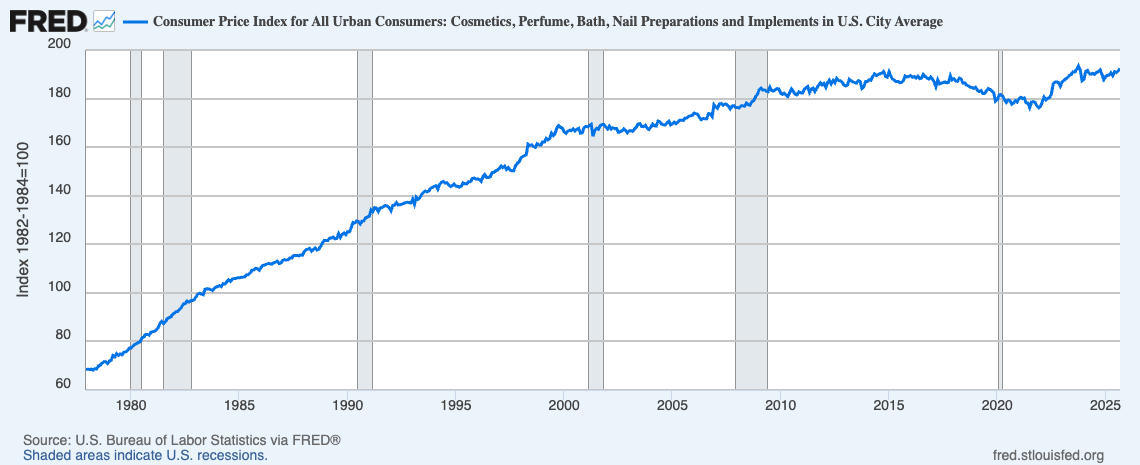

Global beauty is on track to reach $590 billion by 2030, growing at roughly 5% a year, according to McKinsey.

Skin care accounts for about 40% of market value, while mass and “masstige” brands are taking share as shoppers mix $500 creams with $10 lipsticks.

Consumers are segmented by mindset. “Science-backed,” “clean,” or “natural” matter more than demographics like age and gender.

The premium tier is holding steady, expanding from $159.6 billion in 2025 to a projected $216 billion by 2035, led by Asia-Pacific markets that now represent 38% of global demand.

Yet value has become the new luxury. Nearly half of beauty shoppers now buy across price tiers, forcing retailers to stock a wider mix while brands compete on perceived efficacy and emotional resonance.

Generative AI could add $9–10 billion in value to the beauty economy by accelerating design, testing, and personalization. Early adopters are using it to design packaging in days instead of weeks and craft hyperpersonalized marketing that boosts conversion by up to 40%.

Virtual try-ons, AI-powered chatbots, and data-driven product testing are turning customer data into competitive advantage. But 60% of Western consumers remain skeptical of AI-generated content.

The same technologies driving product discovery are reshaping self-perception, and demand for physical transformation.

Cosmetic surgery is moving younger. In the U.K., facelift procedures rose 8% last year, and surgeons now report patients as young as 28 seeking operations once reserved for those over 50.

London surgeons Rajiv Grover and Georgios Orfaniotis told The Guardian that the “deep plane” facelift, once elite, has gone mainstream, used not for anti-aging but “beautification.”

Social media, weight-loss drugs, and “filler fatigue” have made invasive procedures feel routine.

In Turkey, packages start under £6,000; in the U.S., top surgeons can charge $40,000 or more.

Yet regulation lags behind marketing. Beverly Hills surgeon Daniel Gould warned that terms like “mini-lift” or “micro-lift” are often gimmicks, and that patients rarely know whether their surgeon is fully trained or merely certified after short cosmetic courses.

That’s all for today!