Hi there,

Welcome to FinSoar. Today, I look at Nvidia’s $5T moment and what is actually priced in, a Chipotle reset that says a lot about mid-market diners and student-loan-strained wallets, and Hershey’s Halloween math as cocoa and tariffs collide:

Nvidia at $5 trillion: what’s priced in, what still isn’t

Nvidia is now the first $5 trillion company, a marker of how central its accelerators have become to the AI capex cycle and to index leadership.

The stock cleared the milestone after management disclosed $500 billion in chip orders, a slate of US government supercomputers, and partnerships spanning telecom and robotics, while also highlighting that Blackwell chips are now in production in Arizona with US assembly to follow.

The company’s weight in the S&P 500 has topped 8%, and its market cap growth timeline — from $4 trillion to $5 trillion in 16 weeks — is compressing benchmarks in ways that magnify single-name risk.

Two forces are pushing from opposite directions. On one side, hyperscalers are stepping up capex again. Microsoft, Meta and Alphabet each guided higher, largely for AI data centers, which supports unit demand for accelerators and networking through 2026.

On the other hand, China remains a swing factor.

Nvidia currently forecasts no China revenue this quarter, implying a $2–5 billion sales headwind, and there was no summit announcement greenlighting chip sales.

President Trump said Blackwell wasn’t specifically discussed and that Nvidia should negotiate directly with Beijing, with the US willing to be an “arbitrator,” according to reports.

That headline mix helped produce a modest pullback after the run, even as the five-day gain remained double digits.

Policy positioning is now part of the equity story. The company is moving manufacturing and assembly onshore, investing in US supercomputing, and pitching its role in 5G/6G stacks, including a $1 billion Nokia partnership, as it argues for export licenses and national-security alignment.

Meanwhile, regulators and central banks keep warning about AI bubble dynamics and circular financing across the ecosystem, even as the market rewards capacity announcements and backlog growth.

What to watch next?

First, license cadence and the 15% levy on any China sales, which will shape mix and margins.

Second, capex conversion: Nvidia cited 20 million next-gen GPUs shipping through next year. Investors will want to see that backlog turn into sustained data center revenue and free cash flow, not just orders.

Third, competitive pressure from AMD and custom silicon that could test pricing and share even if near-term demand stays tight.

Nvidia is both a growth engine and a macro variable. Its orders influence GDP arithmetic via data center buildouts, its licensing sits inside trade talks, and its index weight shapes passive flows.

Even the spillovers can be quirky: in Seoul, a photo-op over fried chicken during Nvidia’s visit helped spark a local rally in restaurant and robotics names — a reminder of how far the “AI trade” now travels.

Chipotle’s stumble says a lot about the American consumer

Chipotle just gave Wall Street a clean read on mid-market dining, and it was not comforting. The company cut its same-store sales forecast for the third straight quarter and said traffic fell again in Q3.

Shares dropped about 19% on Thursday, the worst day since 2012, and are now down roughly 45% year to date.

Management’s explanation lines up with other “two-tier economy” signals. Households under $100,000 in income, which account for about 40% of Chipotle’s sales, are pulling back. The 25–35 cohort is visiting less, pressured by higher unemployment, resumed student loan payments, and slower real wage growth.

Many are shifting to grocery and food at home rather than to competing restaurants.

There’s a larger pattern worth observing here: McDonald’s and Wendy’s have flagged softer breakfast demand as low-income diners skip the most “cuttable” meal, citing economic anxiety and tariff effects.

Costs are a second headwind. Beef is Chipotle’s largest input. New import levies raised by the White House are pressuring margins, along with inflation in other commodities. The company is guiding to “slow and measured” menu price increases in 2026, but several brokers warned that weak traffic limits pricing power. BTIG and others cut targets and cited likely margin contraction if traffic does not recover.

The weakness looks broader than a single ticker. Cava and Sweetgreen fell 6–8% in sympathy, and Business Insider’s shorthand for the category, “slop bowl” stocks, captured the idea that a once-durable eating habit is now discretionary for younger households.

Chipotle’s CEO said the brand is not losing to rivals. It is losing to the supermarket aisle.

The one thing that I find ironic is the company’s long-run success minted founder Steve Ells as the “first burrito billionaire” earlier this year, a milestone built on three decades of store growth and stock appreciation.

For investors, two questions matter: How deep is the traffic reset if student loan amortization, wage softness, and youth job markets persist?

And how much operating leverage Chipotle can still extract if it cannot raise prices into declining visits?

Hershey raised its full-year sales and earnings guidance after beating expectations, leaning on mix and pricing in chocolate and steady gains in snacks.

The company now sees about 3% net sales growth for 2025 (from at least 2% prior) and lifted the low end of EPS to $5.90, helped by strength in SkinnyPop and Dot’s Pretzels where volumes rose 11% as category pricing fell 1%.

In core North America confectionery, volumes slipped 1% while prices climbed 7%.

That mix story sits on top of two headwinds: cocoa and tariffs. Cocoa futures remain far above pre-2022 levels after weather-hit West African crops, and retailers and brands are leaning on promotions to protect share as consumers balk at sticker shock.

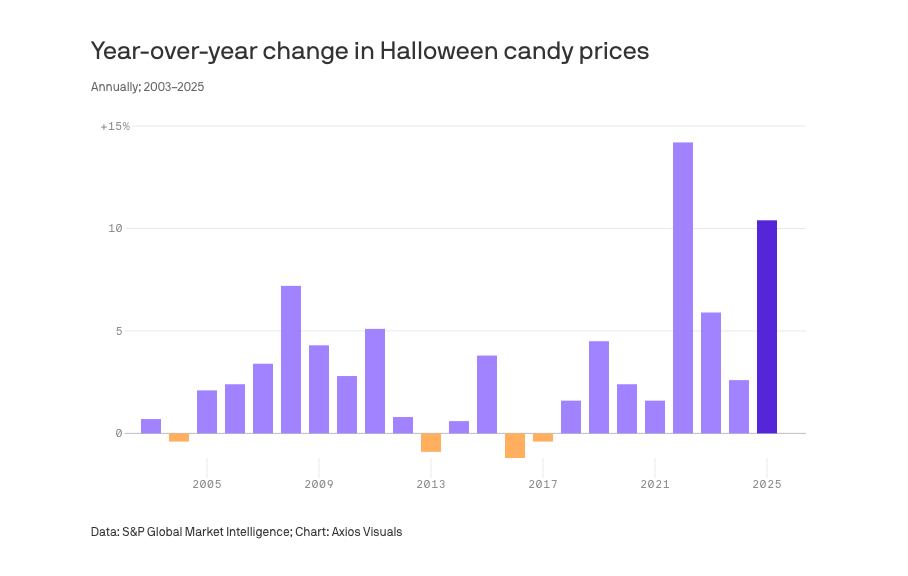

Analysts estimate candy prices are up about 10% this Halloween season, with chocolate-based treats up 20% in some cases as climate-driven supply tightness meets policy-driven import costs.

Hershey guided to $160–$170 million of annual tariff expenses, a bit below August on lower Canadian retaliation, and has said earlier price moves did not fully cover two years of inflation.

Halloween is the key retail moment, and this year started soft.

Management cited warmer weather and a Friday holiday that pushes purchases into the final week.

Third-party data show discounts began earlier, ran deeper, and covered more SKUs than usual across seasonal candy, with one mass retailer promoting over half of Hershey’s Halloween items by early October.

Unit sales for chocolate were flat in the run-up, with prices up ~8% and value still growing, but shoppers are watching pack sizes closely amid “shrinkflation” concerns.

The competitive context matters.

Mondelez just cut guidance on value-conscious consumers and cocoa pressure, suggesting a tougher set-up for global confection even as gummies and sours keep growing.

Hershey’s playbook — premium chocolate, volume in salty snacks, and targeted promos to protect seasonal sell-through — looks rational for margins, but the path runs through volatile inputs and a consumer who wants value instead of a higher price tag.

For a century-old brand shaped by bouts of competition and reinvention, from Mars’ 1960s assault to today’s cocoa shock, that balance is the business.

Sources: Reuters, The Guardian, Axios, Philadelphia Inquirer.

That’s all for today!