Hi there!

Welcome to FinSoar. For this edition, I’m looking at the latest turns in the US-China trade war (rare earths, pharmaceuticals, and the impending meeting), followed by pharma prices, and the French jewel heist:

Markets & Geopolitics: US–China trade, from rare earths to “nuclear” pharma leverage

Trade officials from Washington and Beijing are in Kuala Lumpur this weekend trying to keep a lid on escalation before a Trump–Xi sit-down next week in South Korea.

The agenda: roll back fresh friction over rare-earth export controls, avert threatened 100% US tariffs on Nov. 1, and keep supply chains moving.

Asian equities firmed after the White House confirmed the leaders’ meeting, and European shares mostly held gains from earlier in the week.

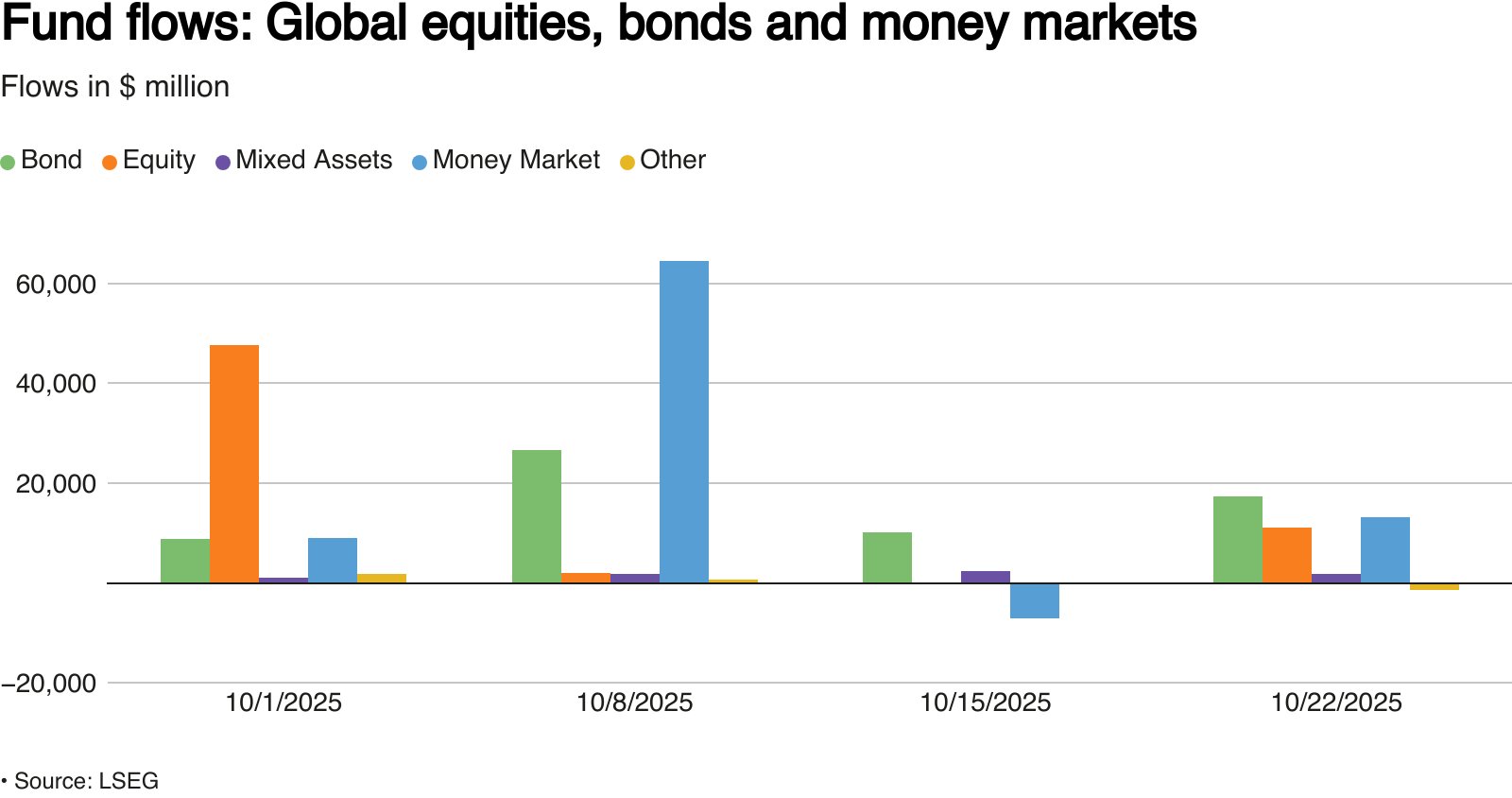

Fund flows echoed the move, with global equity funds taking in $11bn which is the most in three weeks, as trade hopes and earnings supported risk appetite.

It’s important to note that Beijing’s leverage extends beyond magnets: active pharmaceutical ingredients (APIs).

China’s upstream grip — from key starting materials to APIs used in hundreds of US medicines — is being described as a potential “nuclear option” if talks sour, even if no one expects it to be used lightly given the likely global backlash and blowback to Chinese patients and exporters.

The US is hinting at reshoring and tariff threats on pharma if needed; China is carving out humanitarian exemptions in recent controls but has widened curbs tied to defense-adjacent uses.

At the same time, Beijing’s Fourth Plenum doubled down on a five-year blueprint prioritizing tech self-reliance (quantum, biotech, 6G), heavier industrial capacity, and national security. This was a contrast officials were happy to emphasize as Washington wrestles with a shutdown and data delays.

The resource competition also runs undersea. The Cook Islands are now a stage for US–China jockeying over deep-sea minerals critical to clean energy and defense. Both sides are funding surveys and partnerships amid growing environmental concerns. (The Guardian).

Near-term, a tactical de-escalation looks plausible, and markets are already pricing it. The structural rivalry remains in place, including tech controls, resource choke points, and industrial policy on both sides. Any progress in Kuala Lumpur will likely focus on magnets, soybean purchases, and timelines rather than the deeper imbalances each side wants to fix.

Sources: Reuters, Independent, Yahoo, Bloomberg, CNN, The Guardian

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Drug Prices: Trade Wars, Tariff Threats, and a “TrumpRx” Discount

The White House has opened a new front in its trade and pricing campaign, this time targeting foreign drug markets.

President Trump’s team is preparing a Section 301 investigation into whether U.S. trading partners are underpaying for medicines, a step that could lay the groundwork for new drug tariffs.

The move follows months of tariff threats and price demands aimed at drugmakers and U.S. allies.

The pricing gap is the administration’s rallying cry. U.S. drug prices average nearly three times those in other developed nations, with Ozempic around $936/month in the U.S. versus $147 in Canada and $83 in France.

At home, the White House launched TrumpRx.gov, a direct-to-consumer hub where manufacturers listing discounted prices can route patients to purchase channels.

Pfizer agreed to cut some prices by 50–85%, won a three-year tariff reprieve, and pledged $70B in U.S. investment, expecting others to follow suit.

As a result, the S&P 500 Pharmaceuticals Index logged its best week since 2002 as investors bet that company-by-company deals would defuse the bigger policy risk.

Abroad, prices could move the other way.

UK ministers are weighing up to a 25% increase in what the NHS pays to end a standoff with industry and ease U.S. tensions, which is a shift that could redirect pharma capex back to Britain.

European pharma shares also rallied on hopes that overseas pricing will rise to compensate for U.S. concessions; AstraZeneca, Roche, Novo Nordisk, and others popped after the TrumpRx announcements.

One caution: policy-by-press-release risk. Analysts and health economists told the New Yorker that Pfizer’s concessions are limited (narrow Medicaid scope, DTC routing), and the impact on most insured U.S. patients may be muted for now.

Still, the direction is clear in the near term: some U.S. prices down via deals; higher ex-U.S. prices via trade pressure, with a formal Section 301 probe now in motion.

Sources: Financial Times, Reuters, The Guardian, Bloomberg, CNBC, New Yorker, FiercePharma

The Louvre heist, in seven minutes

Source: CNN

Paris just saw one of its most audacious museum robberies in a century: eight 19th-century jewels linked to France’s imperial families were snatched from the Louvre’s Galerie d’Apollon in broad daylight, in a job that took minutes and left a national migraine in its wake.

Around 9:30 a.m. local time, a crew used a truck-mounted basket lift by the Seine to reach a first-floor window, cut the glass with power tools, and entered the gallery.

The thieves smashed two high-security cases, threatened guards, and exited to waiting scooters; they were inside for roughly four minutes, according to French officials.

A new clip appears to show two suspects descending the lift and riding off on motorbikes; investigators say DNA traces were found in a helmet and gloves recovered near the scene.

The haul included tiaras, necklaces, earrings, and brooches tied to Empress Eugénie, Empress Marie-Louise, Queen Marie-Amélie, and Queen Hortense. These jewels are valued by prosecutors at about €88m (~$102m), with far greater historical significance.

The crown of Empress Eugénie was dropped, damaged, and recovered during the getaway.

French media report patchy CCTV coverage in parts of the gallery and an issue with a local alarm. The culture ministry says wider alarms did trigger, and staff followed protocol. The museum’s director offered to resign; the culture minister declined to accept it

The Louvre reopened, though the Apollo Gallery remained closed while about 100 investigators sift evidence.

So what happens to stolen jewels?

Experts say jewels are harder to trace than paintings: stones can be re-cut, settings melted, and components fenced for a fraction of headline value, potentially 10–30% on illicit markets, making recovery a race against the lapidary’s wheel.

Investigations typically blend forensics, CCTV trawls, informants, and occasional undercover buys; arresting the on-site crew is likelier than recovering intact pieces if the stones are split up quickly.

These pieces are part of France’s long, turbulent saga of crown jewels, much of which was destroyed or dispersed after the Revolution. The remaining 19th-century items had come to symbolize a complicated national heritage now suddenly thinner under the vitrines.

Sources: BBC, Yahoo News, Al Jazeera, NPR, The Conversation

That’s all for today!