Hi there,

Welcome to FinSoar!

I decided to start FinSoar to help readers rise above the consistent cacophony of finance, business, and cultural news, and today’s market is just one conflicting mess.

This week, consumer spending still looks sturdy despite an ailing jobs market, Tesla is trudging through the consequential swamp of expensive mistakes, and OnlyFans is gaining traction on tech giants with a quiet and efficient revenue strategy:

Recession Fears Return, Even as Consumers Keep Spending

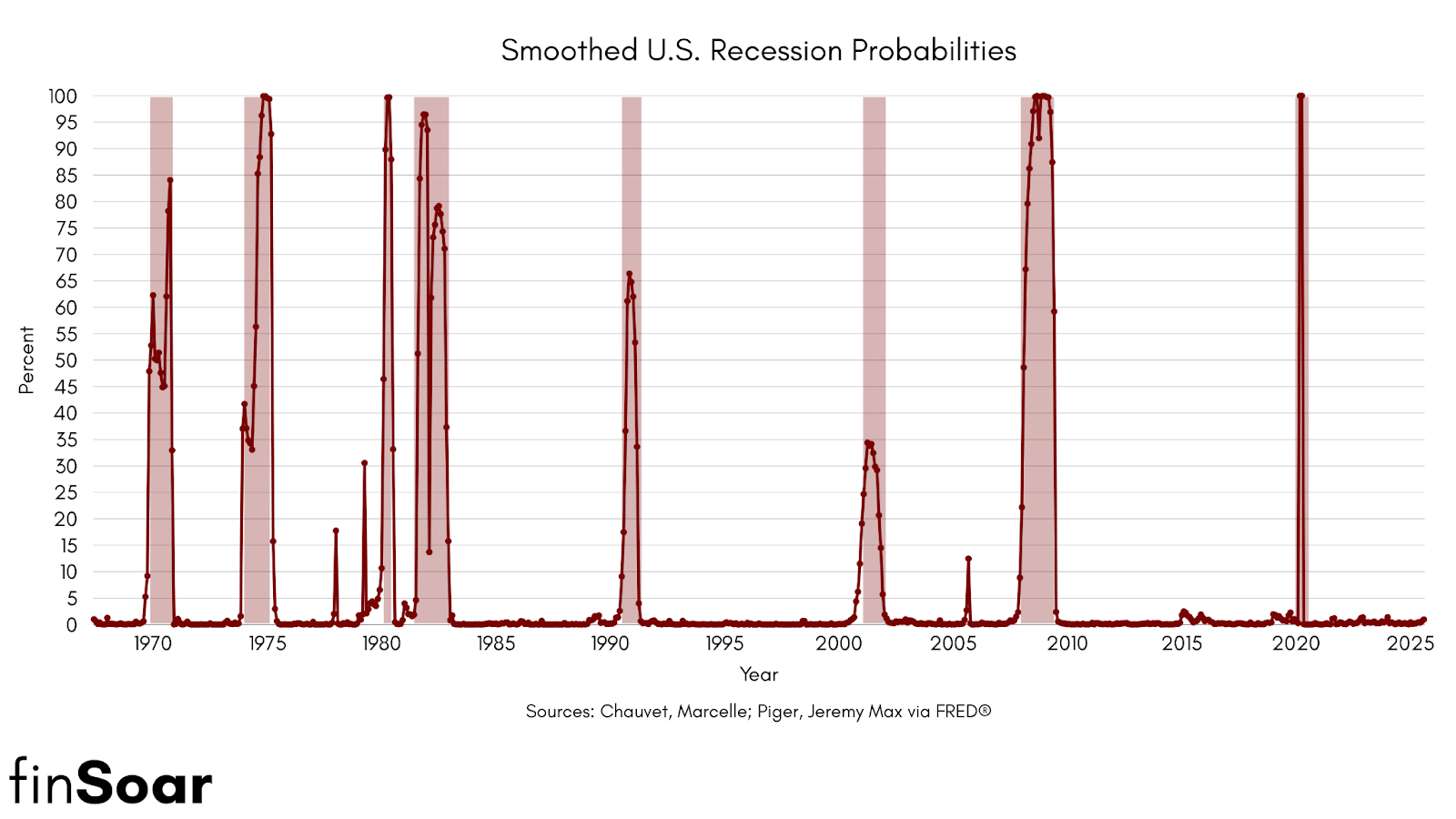

Smoothed U.S. Recession Probabilities. Shaded areas indicate U.S. Recessions

Consumers are still swiping their cards, but the labor market is cracking, housing is rolling over, and the Fed is openly worried. The U.S. may not look like it’s in recession yet — GDP growth near 3% and strong retail numbers — but the job data say otherwise.

Spending remains healthy: real consumption rose ≈ 2.2 % annualized in the first half of 2025.

Yet history shows consumer pullbacks usually follow recessions, not prevent them. Durable-goods spending has already flattened, a warning sign that households are hesitating on big-ticket buys as tariffs distort prices.

Job Market Cracks

Private-sector payrolls fell 32,000 in September, according to ADP:

Hiring plans: down 58 % year-over-year, slowest since 2009.

Planned layoffs: 946 000 so far this year — highest since 2020.

Unemployment: 4.3 %, up ≈ 1 point in two years; historically, such an increase has always coincided with an NBER-defined recession.

Manufacturing and construction are soft spots: residential investment has contracted in five of the past six quarters, implying ≈ 300,000 potential housing-sector job losses. Heavy-truck sales — a classic pre-recession tell — are down 27 % from 2023 peaks.

The Fed has already delivered one rate cut and is hinting at more:

Minutes (Oct 8): Most officials backed further easing due to a “worsening labor market.”

New York Fed’s John Williams: “If unemployment rises beyond 4.3 %, I’ll back lower rates this year.”

Powell’s dilemma: “There are no risk-free paths,” he told reporters.

Inflation remains above target (≈ 3 %), tariffs keep goods prices sticky, and a government shutdown has delayed official data, leaving policymakers “flying blind.”

Hard vs Soft Data

GDPNow still points to ≈ 3.8 % growth, but private indicators tell a different story:

Credit-card balances are falling for the first time since COVID.

Home-improvement searches and sales are plunging.

Consumer confidence sits near recession-era lows.

On paper, America’s economy is humming. In practice…it’s kind of limping.

Spending has held up, but employment, investment, and confidence are faltering. With 25 states already showing rising joblessness, the next move from the Fed — and how fast it cuts — may decide whether this slowdown stays “soft” or tips into something official.

According to Axios, 22 states are in or close to recession, with the District of Columbia, West Virginia, Iowa, Maine, and New Jersey at the most risk.

Source: Axios

Stay tuned for a deeper analysis on Monday, and don’t hesitate to send me your questions.

Sources: Bravos Research, Business Insider, The Bondad Blog, CNBC, Bloomberg, CNN, NY Times, MarketWatch, Axios

Stocks: Tesla’s “Affordable” Play That Did Not Wow Wall Street

Source: Open EV Charts

Tesla finally rolled out “Standard” versions of its Model Y and Model 3 at $39,990 and $36,990. The trims are roughly $5,000 cheaper than the premium versions, but investors quickly decided the discount wasn’t deep enough to spark new demand.

Shares slipped about 4 percent after the reveal, a move many analysts described as a pricing lever rather than a new growth story.

Elon Musk unveiled the two “Standard” trims — each offering 300-plus miles of range but fewer premium finishes and features. Orders opened immediately, with most U.S. delivery estimates showing December to January.

The rollout followed the expiration of the federal $7,500 EV tax credit, which had propped up U.S. demand through September. “It’s basically a pricing lever and not much of a product catalyst,” said Shay Boloor of Futurum Equities in a reaction roundup published by Reuters.

For years, Musk has promised a truly mass-market EV priced around $30,000 after incentives. These new models fall well short of that mark.

Even after the trim cuts, buyers are still paying more than they would have a month ago when the tax credit applied. The result is a cheaper car on paper, but not necessarily in the showroom.

Tesla’s stock fell roughly 4 to 5 percent on launch day. Wedbush analyst Dan Ives called the cuts “relatively disappointing,” while traders on X joked it was “buy the rumor, sell the Standard.” Dennis Dick of Triple D Trading told Reuters that expectations had simply “gotten too heavy.”

In the United States, a sub-$40k Model Y undercuts the Hyundai Ioniq 5, Chevy Blazer EV, and Volkswagen ID.4, offering some near-term cushion.

But in Europe, where more than 25 new EVs are due next year and many are priced below €30,000, the Model Y Standard enters a saturated field.

“It isn’t going to break the market open in a way that a €30,000 vehicle would,” said AutoForecast Solutions analyst Sam Fiorani in Reuters’ European coverage. Tesla’s European market share has already halved to about 1.5 percent since 2023.

To hit the lower sticker, Tesla stripped out touches like Autosteer and certain interior screens. The result, analysts say, is a car that looks less like a tech statement and more like a standard crossover — good for volume, bad for margins.

Just as Tesla tried to change the price narrative, regulators opened a new investigation into its Full Self-Driving (FSD) software after reports of traffic-signal violations and several crashes.

The Guardian reports that the probe covers about 2.9 million vehicles and could lead to a recall if safety violations are confirmed.

Here’s what to keep watch of:

Whether Tesla pushes below the $35k line in 2026.

How U.S. orders hold up without tax credits.

European market share as sub-€30k EVs flood showrooms.

Progress or more probes on autonomy.

Tesla is calling this “affordable.” The market calls it adequate. It may steady sales into year-end, but it doesn’t reset the story. Tesla remains caught between two narratives — premium margins and mass-market scale — and a sub-$40k badge doesn’t fully solve either.

Sources: Reuters, Business Insider, Sherwood News, The Guardian

OnlyFans: The Leanest Cash Machine in Tech?

Source: Multiples

OnlyFans looks like the most “revenue-efficient” consumer internet company on the planet. The platform booked:

$1.4 billion in revenue on

$7.2 billion of fan spending in FY2024 with just ~46 employees,

While total users hit 377.5 million

And creators 4.6 million.

Depending on how you measure, revenue per employee ranges from ~$31 million in 2023 to ~$38 million in 2024 — an order of magnitude above Big Tech averages.

The business is simple: creators keep 80% of what fans pay; OnlyFans takes 20%.

When fans spent $6.6 billion in 2023, platform revenue reached $1.3 billion and pre-tax profit $658 million — and both creator and fan accounts grew nearly 30% year over year.

Momentum carried into 2024: fan spend rose to $7.2 billion, pushing revenue to $1.4 billion with that tiny headcount.

By one 2023 snapshot, OnlyFans generated $1.3 billion with 42 employees—about $31 million per employee, versus $2.4 million at Apple and $1.1 million at Microsoft.

A 2024 dataset pegs the figure even higher at $37.6 million per employee, ahead of names like Nvidia and Alphabet.

Methodology matters here: these tallies count full-time staff and exclude contractors, but the takeaway is the same — this is a tiny organization monetizing a massive two-sided network.

Owner Leonid Radvinsky has taken out nearly $1.8 billion in dividends since 2021, including $497 million in FY2024, as the company explored a potential sale at about $8 billion.

Earlier filings showed a $472 million dividend in 2023 and cumulative payouts above $1 billion since 2020.

Management continues to pitch expansion beyond adult content — think OFTV with fitness, cooking, comedy, and music — while investing in public-affairs work to “address misconceptions” and manage security risk disclosures.

For high-income investors used to FAAMG scale, OnlyFans is a reminder that unit-light platforms can throw off outsized cash without giant payrolls.

The risk ledger is real — regulatory scrutiny, brand safety, creator churn — but the operating model is clear: low fixed costs, take-rate on huge GMV, and a network that keeps compounding.

If you are mapping the creator-economy stack, this is the benchmark for revenue efficiency — and a case study in how much leverage a focused, no-frills platform can generate at a global scale.

What’s the most actionable takeaway for you this week?

That’s all for today!