Hi there!

Welcome to FinSoar. This week Bitcoin plunged 8%, the Yen Carry Trade is raising some important questions, and a surprising Hollywood victory in China is the talk of the town:

Bitcoin's $1 Billion Liquidation NightmareBitcoin plunged as much as 8% on Monday to below $84,000, triggering over $1 billion in forced liquidations and erasing last week's modest recovery. The world's largest cryptocurrency is now down roughly 32% from its October record high above $126,000.

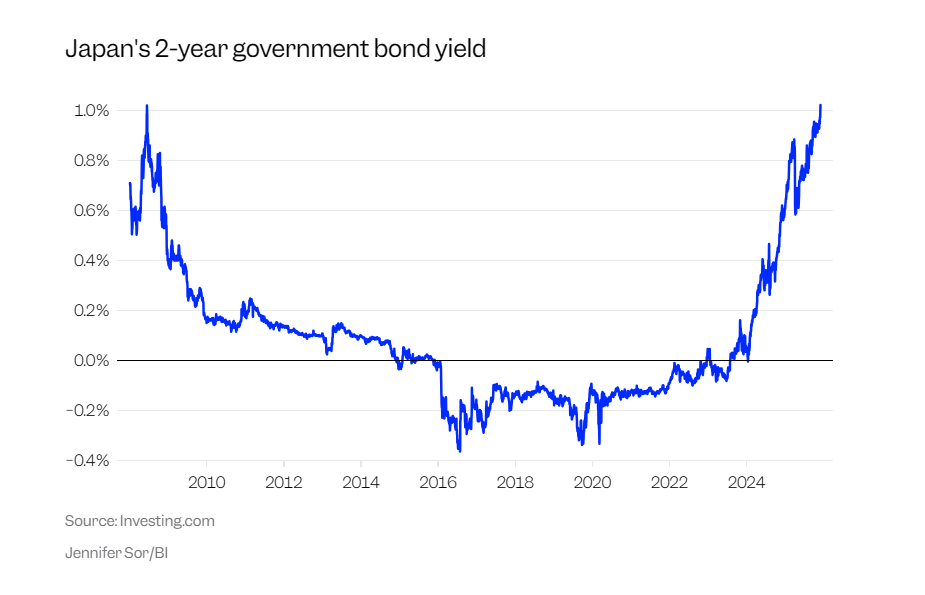

The selloff is driven by multiple factors. The immediate catalyst appears to be Japan's central bank suggesting it could raise interest rates this month. That threatens the yen carry trade, where investors borrow cheap Japanese yen to buy higher-yielding assets like US stocks and bitcoin. Japanese bond yields just hit their highest level since 2008. When this unwound in August 2024, bitcoin plunged 18% in days, from over $66,000 to around $54,000. The second problem is leverage. Ben Emons at Fedwatch Advisors told CNBC there's up to 200x leverage on some bitcoin exchanges, with an estimated $787 billion outstanding in perpetual crypto futures. "There is still a lot of leverage in bitcoin out there," he said. "We can expect some more of these liquidations if bitcoin prices don't get off the lows." Third, retail investors aren't buying the dip anymore. Bitcoin ETFs posted their second-worst month in November with $3.5 billion in outflows. JPMorgan's team monitoring retail trends noted reluctance to scoop up discounted bitcoin. Fourth, Strategy is in trouble. Michael Saylor's bitcoin treasury company announced Monday it had created a $1.44 billion "US dollar reserve" to fund dividends and interest payments. The company warned annual net income could range from a loss of $5.5 billion to a profit of $6.3 billion depending on where bitcoin ends the year. Strategy's stock has fallen more than 60% from recent highs. The leveraged ETFs tracking it, MSTX and MSTU, have plunged more than 80% this year, putting them among the 10 worst-performing funds in the entire US ETF market. The company's mNAV ratio, which compares its enterprise value to its bitcoin holdings, sits at 1.17. CEO Phong Le said slipping below 1.0 could force the company to sell bitcoin, albeit as a last resort. Bloomberg Opinion called it Saylor's "infinite money glitch" glitching out. Strategy holds 650,000 bitcoin, worth about $56 billion, accounting for 3.1% of the world's total supply. The average price it paid? Around $74,000. Bitcoin is now uncomfortably close to that level. The broader market is feeling it too. "Bitcoin shows weak development in a falling trend channel," technical analysis from Investtech warned. The Crypto Fear and Greed Index hit 20 out of 100, indicating "Extreme Fear." The key level to watch is $82,000, widely cited as the average cost-basis for many ETF investors and bitcoin treasury companies. If bitcoin crosses that, bear talk will intensify. Deutsche Bank analyst Marion Laboure put it bluntly: "Unlike prior crashes, driven primarily by retail speculation, this year's downturn has occurred amid substantial institutional participation." Even history isn't on bitcoin's side. The cryptocurrency has only risen between Black Friday and year-end in 54% of cases since 2014. |

Japan's Central Bank Just Scared the Hell Out of Global Markets

Bank of Japan Governor Kazuo Ueda delivered his strongest hint yet on Monday that the central bank could raise interest rates in December. Markets immediately panicked about the yen carry trade unwinding again. "If the outlook for economic activity and prices outlined so far is realised, the bank will continue to raise the policy interest rate," Ueda told business leaders in Nagoya. The probability of a December rate hike jumped to 75% from about 60% following his speech.

Monday felt like a replay. Japan's 2-year government bond yield climbed to 1.02%, its highest level since 2008. The 10-year yield hit 1.8%, a 17-year high. The yen strengthened 0.6% against the dollar. US markets caught the contagion. The Dow fell 427 points. The S&P 500 dropped 0.53%. The Nasdaq fell 0.38%. Bitcoin tumbled as much as 8%. Ethereum dropped 8.9%. "Traders are waking up this Monday after a quiet Thanksgiving to an overwhelming sense of déjà vu," Nic Puckrin at The Coin Bureau wrote. "The Japanese yen carry trade is once again beginning to unwind." Nobody knows exactly how large the carry trade is. Using the narrowest definition, analysts point to $350 billion in short-term external loans by Japanese banks. But actual positions could be much larger due to leverage used by hedge funds and algorithmic traders. Japan's foreign portfolio investments totaled $4.54 trillion at the end of March, more than half in interest-rate-sensitive debt assets. When rates shift, the ripple effects are global. The BOJ's overnight rate currently sits at just 0.25%, while US rates are around 5.5%. But carry trades are more sensitive to rate expectations and currency moves than absolute rate levels. The yen has gained 13% in a month. That completely wipes out the itty bitty gains in pure yen-dollar carry trades. Japan's Finance Minister Satsuki Katayama said Sunday that recent yen swings are "clearly not driven by fundamentals." He reiterated that currency intervention remains possible. The timing is terrible because the Fed is expected to cut rates in December, narrowing the yield gap between Japan and the US even further. Traders are pricing in an 88% chance of a 25 basis point Fed cut next week. "The government is pushing on the accelerator and the BOJ is taking its foot off the accelerator," Marcel Thieliant at Capital Economics told the Financial Times. "It's not consistent with what the government wants, but the BoJ would tell you it's economic logic." Thierry Wizman at Macquarie Group said Japan's central bank appears to be "driving the sentiment shift" in markets this week. The question now is whether this is a one-time hike or the start of a sustained tightening cycle. "A yen recovery would likely need the BOJ to follow through with stronger guidance," said OCBC currency strategist Christopher Wong. For now, investors are bracing for more volatility. December just started and it's already ugly. |

Where to Invest as the Rally Broadens in 2026Goldman Sachs Asset Management sees opportunities beyond mega-cap tech as the market rally broadens. Greg Calnon, cohead of public investing at the bank's asset management arm, highlighted three areas:

Source: Goldman Sachs Asset Management via Business Insider |

Zootopia 2 Breaks China Records

Source: 2025 Disney Enterprises, Inc. Disney's Zootopia 2 pulled in $272 million in China over its first six days, the second-biggest opening ever for a foreign film. Only Avengers: Endgame did better. The sequel accounted for 95% of all movie ticket sales in China over its opening weekend. It surpassed the original Zootopia's $236 million total from 2016 in less than a week. Globally, the film has collected $556 million since Wednesday. China made up nearly half. The success is shocking given Hollywood's recent collapse there. Beijing curbed US film releases this year in retaliation for tariffs. Before Zootopia 2, the best-performing foreign film in China this year was Demon Slayer at $87 million. No Hollywood film cracked the top 10. Local animation Ne Zha 2 raked in nearly $2 billion earlier this year. Disney bet big. CEO Bob Iger traveled to Shanghai for a premiere. The company partnered with China Eastern Airlines on a Zootopia-themed plane. Shanghai Disneyland has the world's only Zootopia-themed land, which opened in 2023. But analysts warn this is an exception, not a trend. "Beijing doesn't view Hollywood as a solution to restrained consumer spending, so I wouldn't read into this being a pivot," Chris Fenton, author of "Feeding the Dragon," told NBC News. "Beijing knows if Hollywood sees some continued promise in their market, filmmakers will continue to kowtow to Beijing's storytelling requirements." Film critic Raymond Zhou said the film's themes of inclusion and mutual understanding resonated without being "overly preachy." Animation has become dominant in China, with Ne Zha, Nobody, and Boonie Bears among the country's top films this year. Hollywood's summer season was the least attended since 1981. Domestic theaters collected just $445 million in October, the lowest on record. China was supposed to save Hollywood. Now Hollywood struggles to even get films shown there. |

That’s all for today!