Hi there,

Welcome to FinSoar, the sea of information for smooth sailing across the world of finance!

You might not remember subscribing to this newsletter, but we’ve been friends for a long while already.

Over a decade ago, when I began my first blog, I could have never predicted the evolution of the internet as it is today. YouTube was still relatively new, Facebook games were popular with the kids, it was cool to be on Twitter, and we were all posting unedited—or heavily filtered—pictures of our food and pets on Instagram. Good times.

Since then, I’ve branched into several different blogs, newsletters, and podcasts. But back then, the finance world was almost unrecognizable.

You didn’t have blogs and newsletters, or YouTube channels, or even Instagram personal finance gurus coaching you to follow the 4% rule or balance a portfolio. It was hard to make money online, unlike the never-ending remote positions millennials and Gen Z can take advantage of.

Back then, your best source of financial news was your dad, that one cousin who had successfully “tapped” into the market, the Wall Street Journal—I know some people who still read the physical copies—and CNBC.

If you wanted to buy stocks, you would physically telephone your broker and patiently wait for them to finish selling you some other stock. They would instruct their minions traders to make the purchase, and the only way you’d know the purchase went through is when the broker would charge you a hefty commission.

It’s a lot easier to lose your money these days!

I started this newsletter to filter through all that news, and bring you something valuable; a mix of data, advice, philosophy, some opportunities, a little bit of entertainment, and of course, the latest in finance.

Because I feel rather nostalgic while keeping up with the changing world, today let’s explore:

Changing housing trends—how are Millennials and Gen Z coping with this odd price change in real estate?

Parasocial finance—Will Taylor Swift’s engagement cause a rise in diamond sales?

So many ways to make money—how have employment trends changed in the 2000s?

Housing Trends in 2025: The Surprise Nobody Saw Coming…or Did They?

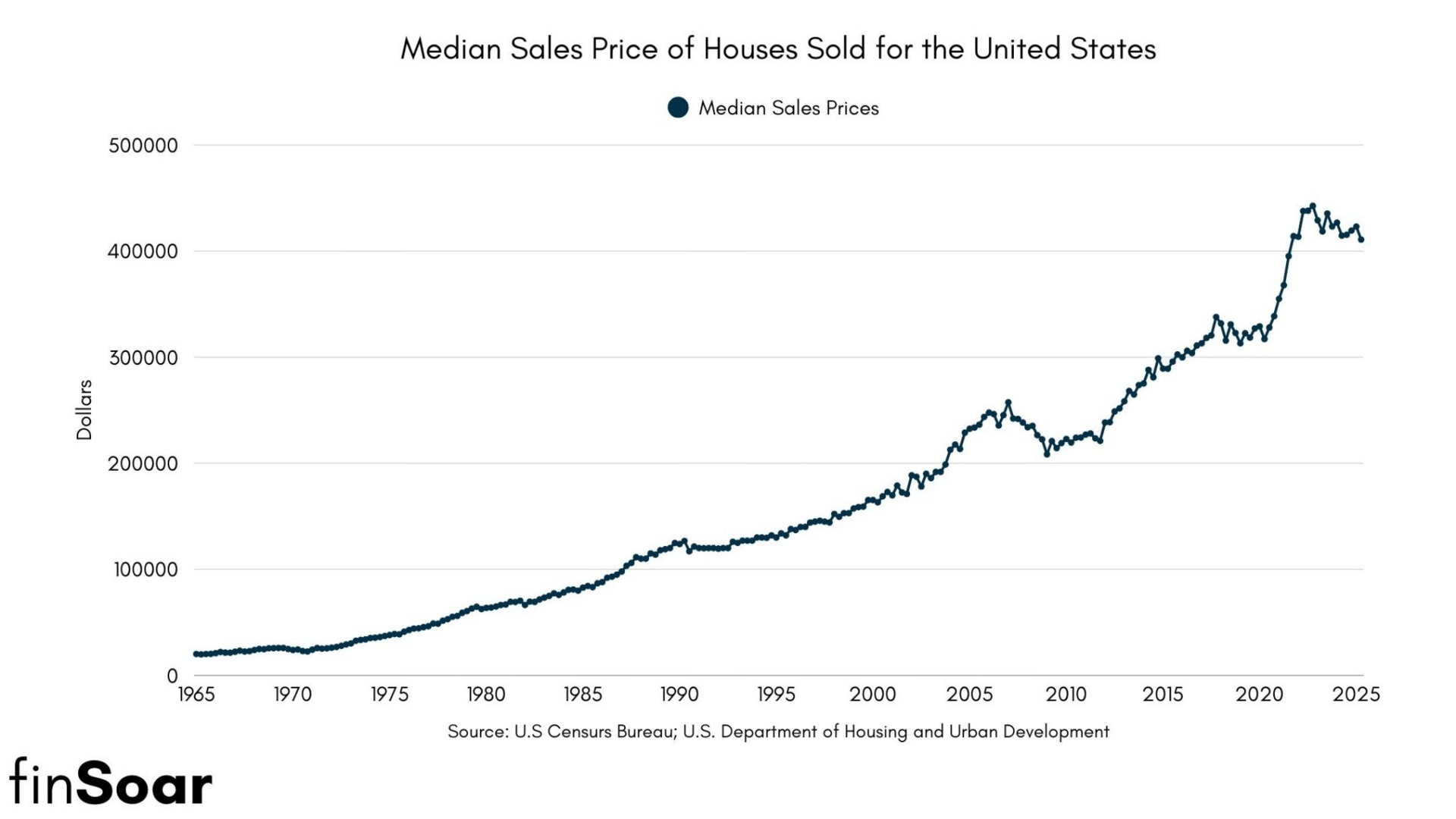

Looking at this U.S. Census Bureau data on US median home prices, here's a reality check that hits different for millennials and Gen Z:

TL;DR: The median home price just hit $410,800 in Q2 2025 - that's more than 20x higher than it was in the early 1970s when many of our parents were house-hunting.

What's wild about this chart:

From 1963 to around 2000, home prices grew relatively steadily

Then things went absolutely bonkers - especially from 2012 onward

That massive spike from ~$200K in 2012 to over $400K today? That happened during our prime earning years

The generational wealth gap in one chart: While boomers could buy homes for under $100K through the '80s and '90s, we're dealing with prices that have more than doubled just since 2012. Even accounting for inflation, today's home prices represent a much larger chunk of median income than previous generations faced.

At the same time, in 2023, 18% of adults (young men more so than young women) aged 25 to 34 resided with their parents, and acknowledged this as a financial but not social strategy.

Silver lining? The chart shows some recent flattening after 2022's peak, suggesting the market might finally be cooling off. But we're still at historically unprecedented levels.

Taylor Swift’s Engagement Made Headlines — But Is It Worth Investing In Diamonds?

Source: Taylor Swift Instagram

You’ve heard the saying (or the marketing): “Diamonds are forever.” “Diamonds are a girl’s best friend.” But is this forever best friend a worthy investment?

Taylor Swift's engagement to Travis Kelce sent jewelry stocks briefly soaring this month, with some gains of 30%+ before reality set in. Her estimated $250,000-500,000 old mine brilliant cut ring had Swifties googling engagement rings and investors betting on a diamond rush.

But here's the thing: diamonds are absolutely terrible investments.

Unlike stocks, bonds, or even gold, diamonds generate zero income and have massive markups. That $10,000 diamond ring? Good luck getting half that back when you try to sell it. The diamond industry is essentially a controlled supply chain with artificially inflated retail prices.

The numbers don't lie:

Buy a diamond: Expect to lose 50%+ of value immediately

Buy gold: 4.9% annual returns since 1928 (but only 3.2% since 1980)

Buy stocks: ~10% historical annual returns

Even the global diamond market, projected to grow at just 3.3% annually through 2030, barely keeps pace with inflation.

Meanwhile, synthetic diamonds are disrupting the whole industry - they're chemically identical to "natural" diamonds but cost 30-40% less.

The Swift reality check: Celebrity engagement announcements might move stocks for a few days, but they don't change fundamental investment math. Signet Jewelers jumped 10% initially but has already given back most gains.

If you want the ring, buy the ring. But don't kid yourself that it's an investment. Your money is better off in index funds, and if you really want alternative assets, even gold's mediocre long-term performance beats diamonds every time.

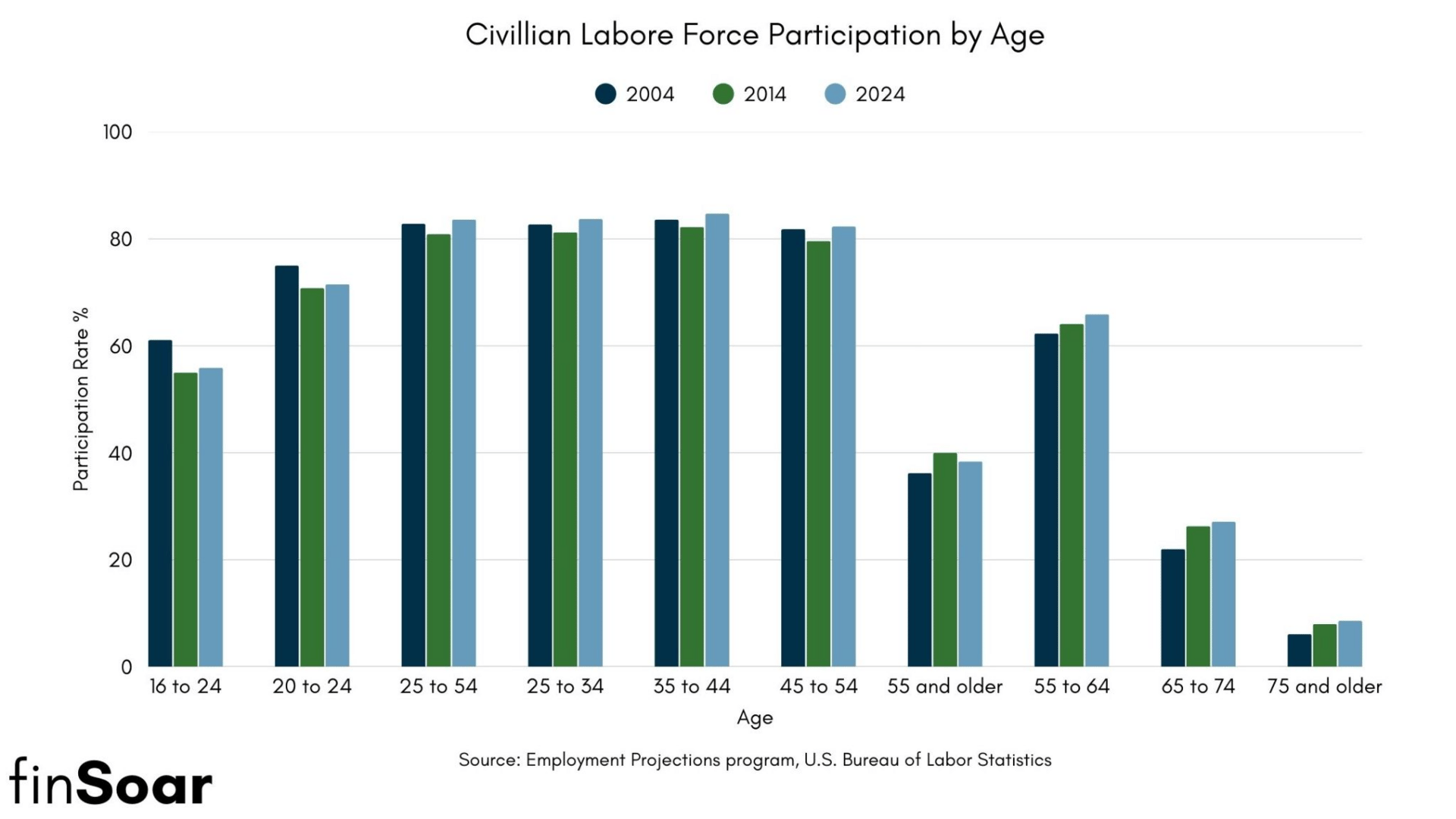

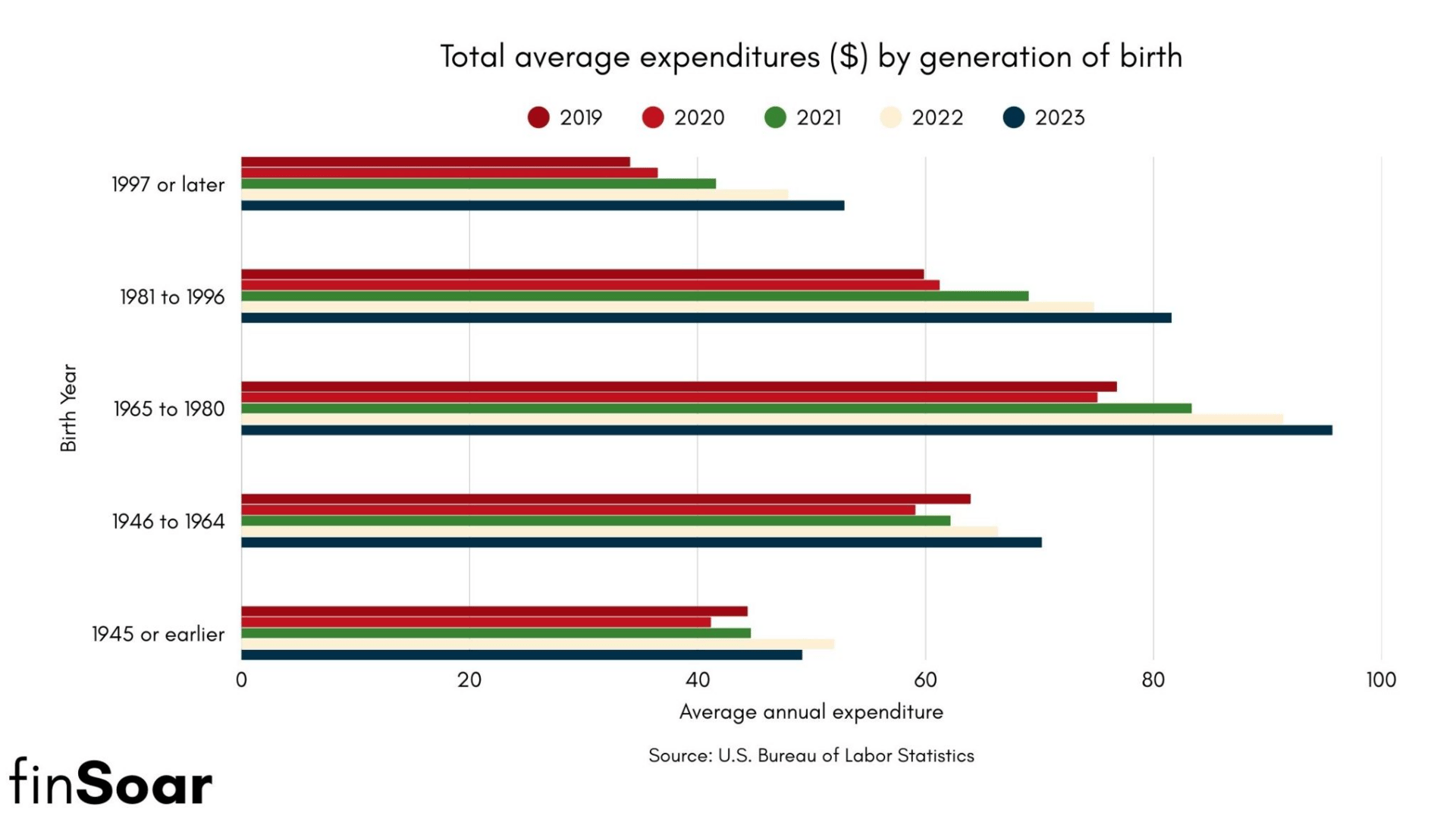

The Great Youth Employment Shift: How 25 Years Changed Everything for Young Workers

The American youth job market has undergone a dramatic transformation over the past quarter-century, with trends that started long before the Great Recession and have only accelerated since.

Now, artificial intelligence is adding a new layer of disruption specifically targeting entry-level positions. Here's what the data reveals about how young people work (or don't work) today compared to the early 2000s.

The Summer Job Became Extinct

The traditional teenage summer job—once considered a rite of passage—has virtually disappeared.

The teen summer employment rate held steady at approximately 50% from 1950 to 2000 before steadily declining after 2000: it went from 51.5% in the summer of 2000 to 48% in 2001; it then declined further to 41.7% (2003), 37.4% (2008) and 32.9% (2009). By 2011, the employment rate for youth ages 16-19 in July 2011 was 24.9%.

The decline started in 2000, seven years before the financial crisis.

Between 2000 and 2009, summer employment rates for all ethnic groups declined between 15 and 20 percentage points. White youth experienced the most dramatic decline, from 56.4% to 36.8% employment.

School Became the New Full-Time Job

One of the biggest drivers was students treating education like a career. More than half (53%) of youths aged 16-19 years were enrolled in school sometime during the summer of 2009, a percentage close to three times higher than that 20 years earlier.

Teens in families with higher educational attainment exhibited a decrease in the time they spent in paid employment and an increase in their rates of volunteering.

College enrollment patterns shifted dramatically, too. Beginning in the late 1980s and early 1990s, a reversal in a decades-long trend began to appear: Women's college enrollment shares were growing faster than those of men, eventually surpassing them.

A rising share of students are doing school full-time and pursuing four-year degrees as opposed to two-year options over the same period.

Young Men Hit Hardest

The labor force participation crisis particularly affected young men. From 2000 to 2022, young men ages 16 to 24 with less than a bachelor's degree contributed the most substantially to the overall declines in labor force participation.

Generationally, the picture is mixed.

Gen Z men have lower unemployment rates than men in previous generations of the same age. Gen Z men's labor force participation tracks with Millennials, yet falls behind Baby Boomers and Gen X.

The Great Recession Accelerated Everything

Young adults bore the brunt of the 2007-2009 recession. Just over half of 18- to 24-year-olds (54.3%) were employed in 2011, compared with 62.4% in 2007, a 13% decrease.

The current employment rate, along with a nearly identical one in 2010 (54.0%), marked the lowest employment-to-population ratio for young adults since 1948.

The wage impact was severe, too.

In 2011, the median weekly earnings of 18- to 24-year-olds who worked full time were $448. That figure was 6.1% less than their median earnings of $477 in 2007, while older workers saw no wage decline.

What Changed and What Didn't

Several structural forces reshaped youth employment:

Reduced funding and additional program restrictions, as well as increases in Federal and State minimum wages, have resulted in municipalities offering fewer summer jobs

Federal funding for summer teen employment, designed to help students save for college, dropped 8% between 1999 and 2009

Increased competition from adults and immigrants for entry-level positions

A cultural shift where affluent parents prioritized education over work experience

AI Delivers the Final Blow to Entry-Level Jobs

The latest disruption comes from artificial intelligence, which is specifically targeting the kinds of jobs young people typically start with.

A groundbreaking Stanford study analyzing millions of payroll records found that workers between the ages of 22 and 25 in jobs most exposed to AI — such as customer service, accounting and software development — have seen a 13% decline in employment since 2022.

In 2022, 19% of American workers were in jobs that are the most exposed to AI, in which the most important activities may be either replaced or assisted by AI.

Workers with a bachelor's degree or more (27%) are over twice as likely as those with only a high school diploma (12%) to see the most exposure.

The college-educated young people who followed the "safe" career advice of the 2000s are now the most exposed to AI displacement. Jobs with a high level of exposure to AI tend to be in higher-paying fields where a college education and analytical skills can be a plus.

The Current Reality

Recent data shows young people have different relationships with work than previous generations. Students have become less likely to look for work while in school, but job seekers have become more likely to find employment.

There are also new pathways emerging: Young men's postsecondary technical school enrollment spiked in 2023, suggesting some are seeking alternatives to traditional four-year college paths.

But the job market reality is harsh.

Since 2023, job postings for entry-level roles have fallen by more than 35% in the United States, according to some estimates. Data from LinkedIn says 63% of executives surveyed admit that AI will likely take over some tasks that entry-level employees currently handle.

What Experts Predict

The expert consensus ranges from cautiously optimistic to deeply concerned. OpenAI cofounder and CEO Sam Altman predicted some people will work "better and faster" with AI, though some will see their jobs "totally go away," and new roles will evolve.

LinkedIn's chief economic opportunity officer offers a more nuanced view: The predictable path used to be, "I got this degree, now give me that job." Which was great if you got the degree, but it was not great if you couldn't afford the degree or if you weren't in a privileged community that gave you a pipeline to get the degree. Now, saying, "I got the degree," doesn't say as much.

The question now is whether this generation can adapt fast enough to a job market that's changing faster than any in human history—and whether society can create the support systems they'll need to thrive in this new reality.

That’s all for today!