Hi there,

Welcome to FinSoar, the sea of information for smooth sailing across the world of finance!

This week, the headlines are less about markets and more about empires — some sung, some elected, and some collapsing in real time:

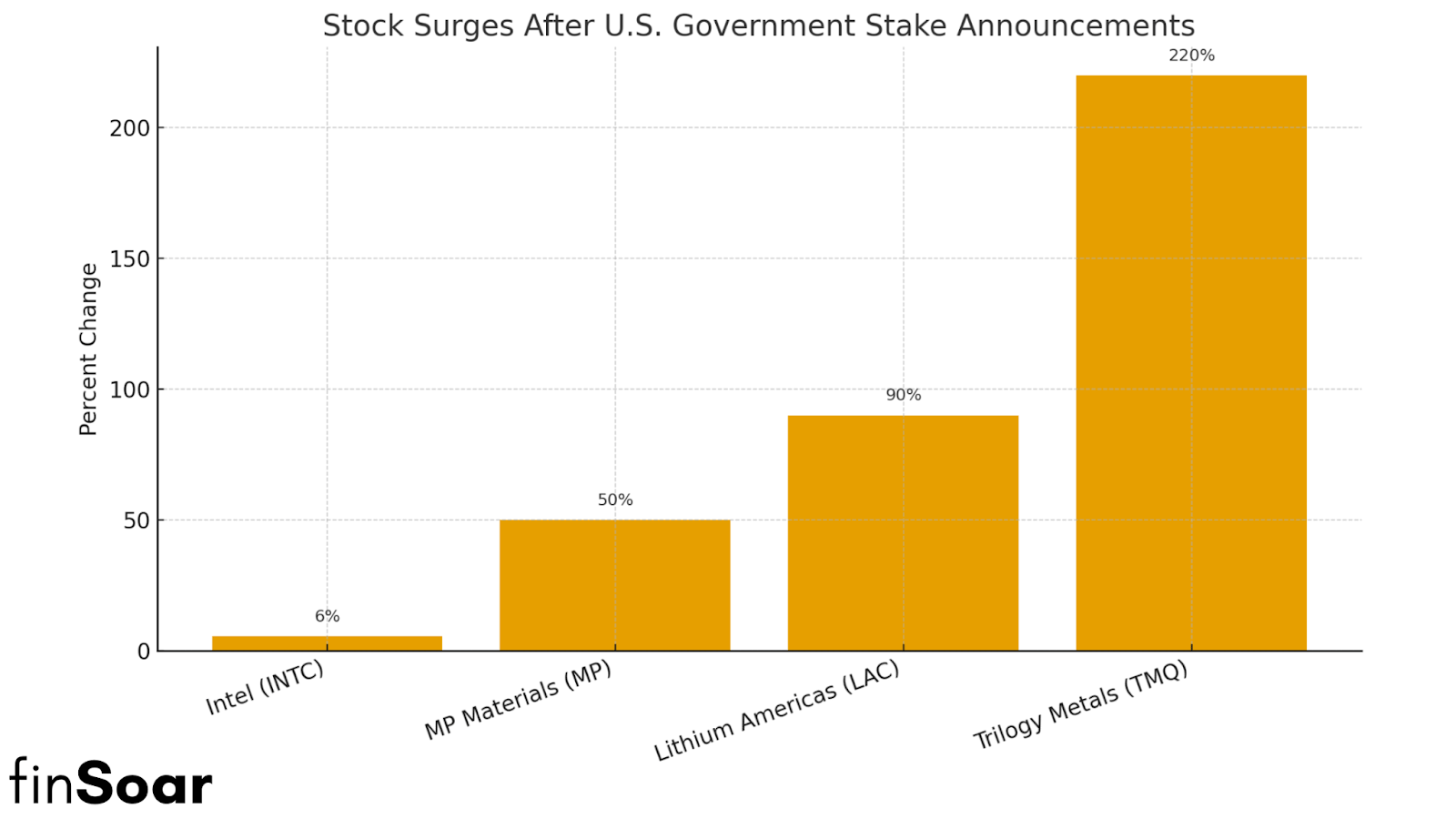

The Trump Pump: From Policy to Portfolio Performance

The Trump administration has taken an unprecedented turn in U.S. economic history — converting federal subsidies into ownership stakes across key industries. From Intel to Lithium Americas, Washington is now an investor in its own economy.

While the White House says it’s about “securing supply chains,” critics argue it’s also reshaping the balance between public policy and private profit — especially when the president’s own business interests keep expanding abroad.

For decades, U.S. presidents have used incentives — tax breaks, grants, and loans — to nudge strategic industries. The Trump administration has gone further: turning subsidies into equity.

According to Reuters, the government has now acquired direct stakes in five public companies, framing it as a national-security strategy. The move signals a return to industrial policy — but this time with dividends.

The Administration’s Equity Portfolio

(as of October 2025)

Company | Sector | Government Stake | Rationale |

Intel (INTC) | Semiconductors | 10% | Converted CHIPS Act grants into ownership to secure U.S. chipmaking. |

MP Materials (MP) | Rare Earths | 15% | Ensures domestic access to critical minerals. |

Lithium Americas (LAC) | Mining | 10% | Strengthens EV battery supply chain; stock rose 95% after stake news. |

Trilogy Metals (TMQ) | Copper & Zinc | 10% + 7.5% warrants | Opens Alaskan Ambler district; shares surged over 200%. |

U.S. Steel (Golden Share) | Steel | Non-equity veto power | Gives Washington control over relocation and closures. |

(Source: Benzinga, Business Insider)

Collectively, these stakes represent a new hybrid model: the White House as venture capitalist.

Meanwhile, Trump’s trade diplomacy has created tension north of the border. Despite a 35% tariff on Canadian imports, the U.S. continues to buy lithium, copper, and auto components from Canada — many from companies benefiting under the very equity program meant to “reshore” production.

As BBC reported, Trump framed the relationship as one of “natural conflict” but “mutual love.”

Markets have responded enthusiastically. Since July, MP Materials’ shares have doubled, and Intel stock is up nearly 48%. Lithium Americas — a Vancouver-based company — saw a 95% spike after CNBC confirmed the U.S. stake proposal.

The administration’s defenders argue that direct ownership creates accountability for taxpayer money. Yet even Wall Street insiders admit this kind of government-led market intervention is unusual. The line between industrial policy and market manipulation has rarely looked thinner.

At the same time, critics note that the president’s personal businesses — especially in energy and real estate — continue to expand abroad, from Qatari resorts to Vietnamese golf developments (DW).

The overlap between public investments and private interests hasn’t gone unnoticed, though so far no direct violations have been proven. As NPR reported, the administration’s own disclosures make one thing clear: “He’s not hiding it — he’s monetizing it.”

If the first Trump term turned politics into television, the second has turned it into a holding company. The family’s ventures — from crypto coins to luxury golf courses — are now part of what The New Yorker calls “a $3.4 billion presidency.”

Whether it’s meme tokens, branded watches, or Gulf resorts co-signed by sovereign wealth funds, the common denominator is the same: the presidency as product line.

As MSNBC notes, this is less about legality than precedent — a redefinition of what public office can be worth in the open market.

For investors, the takeaway is to understand what happens when the government becomes a market participant.

Public policy, once a referee, is now a player on the field.

Europe’s Leadership Crunch

France has cycled through five prime ministers in 21 months, a reflection of minority governance in a splintered Assembly and collapsing cross-party deals.

Lecornu’s exit followed immediate backlash over cabinet composition and threats of no-confidence. President Emmanuel Macron gave him 48 hours to salvage a platform through party talks, while options range from yet another prime minister to dissolving parliament for snap elections.

BBC’s readout calls it the “twilight of an era,” with allies peeling away as the 2027 race nears and “Macronism” loses gravitational pull.

This churn is not only French. In Lithuania, Prime Minister Gintautas Paluckas resigned amid investigations and protests, likely forcing fresh coalition bargaining.

In Romania, Prime Minister Marcel Ciolacu stepped down after his coalition’s candidate faltered in the presidential first round, deepening a shift toward populist forces and new coalition math.

The market signal arrived quickly. The CAC 40 fell about 1.3–1.8%, the euro slipped, and French OAT yields moved above peers like Spain and Portugal as investors priced tougher budget dynamics after Lecornu’s resignation.

With France already facing a ratings downgrade and a tight budget calendar, strategists now see a higher chance of a 2026 “continuation budget,” which implies less policy maneuvering room rather than immediate macro shock.

Short tenures compress legislative windows, delay budgets, and complicate reforms. For investors and operators, the immediate signal is continuity risk, not necessarily crisis.

Near term, the watch items are Lecornu’s talks, Macron’s decision on snap elections, and France’s fiscal path into 2026

Sources: Reuters, BBC, Al Jazeera, DW, Guardian live, CNN

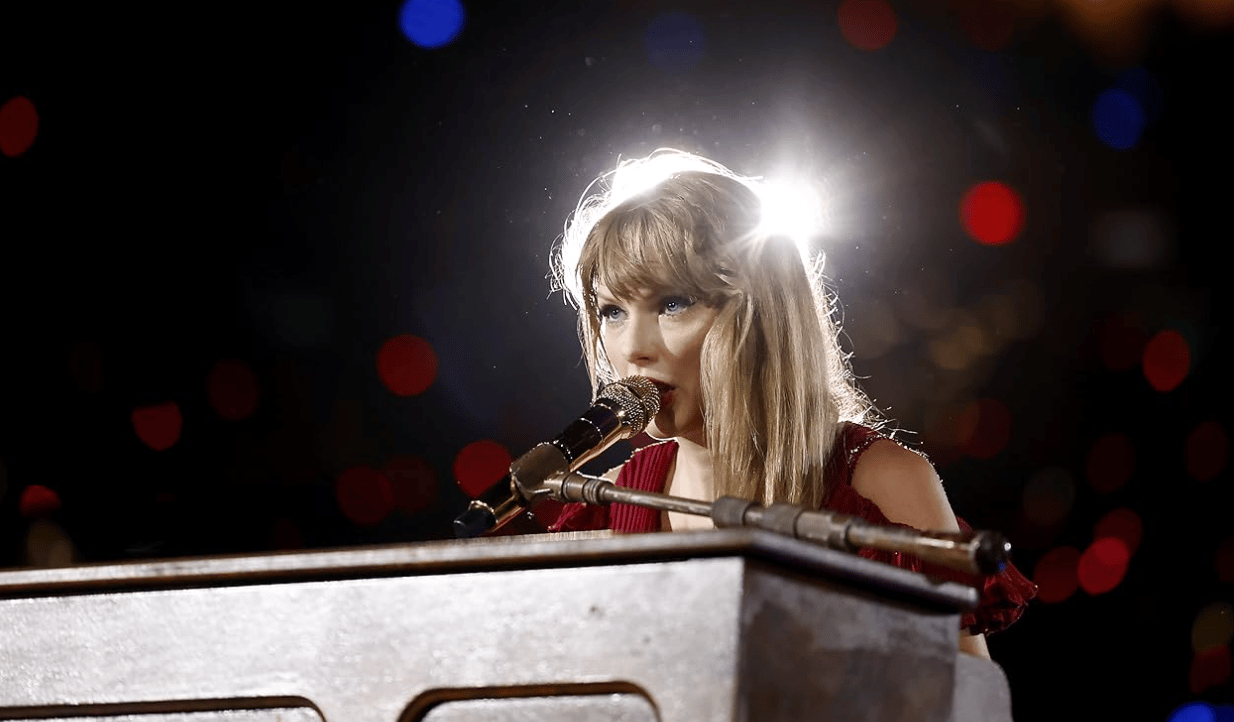

Taylor Swift's $2.1 Billion Empire: Record Sales, Mixed Reviews, and an AI Controversy

Source: Emma McIntyre/TAS23/Getty Images for TAS Rights Mana - © 2023 TASRM and Getty Images

The pop star's latest album shattered sales records and topped the box office — but not everyone's impressed with the music.

Taylor Swift's "The Life of a Showgirl" sold 304,000 copies in its UK first week — eclipsing her last two albums and securing the biggest opening week of 2025.

In the US, she moved 2.7 million copies on Friday alone, marking her biggest sales week ever and the second-largest for any album since 1991 (only Adele's "25" did better, and what an album that was!).

The album's 90-minute theatrical "release party" film grossed $34 million domestically in one weekend — the biggest album debut event in cinema history.

Globally, it pulled in $50 million.

These numbers pushed Swift's net worth to $2.1 billion, up $1 billion from two years ago, according to Bloomberg. Forbes pegs her at $1.6 billion, making her the first musician to reach billionaire status primarily from songs and performances rather than side hustles like makeup lines or endorsements.

Variety called it "contagiously joyful" while the Financial Times said it "lacked sparkle," BBC reported. Pitchfork gave it a 5.9, saying "her music's never been less compelling."

But the harshest criticism came from fans themselves. The Alternative gave the album a scathing review that's been circulating widely on social media, calling it "the year's most disappointing blockbuster pop record" and noting that songs like "Wood" sound "too trite to have even been a Man's Best Friend throwaway."

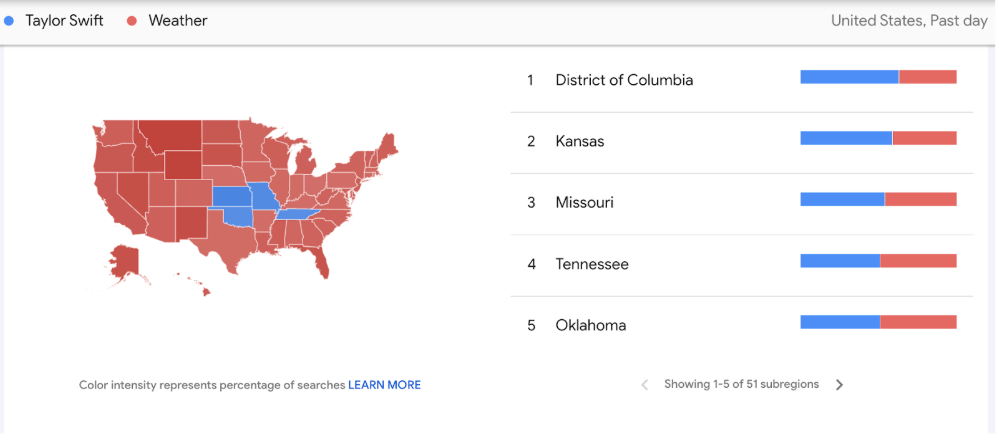

On her album release day, five U.S. regions searched for Taylor Swift more than the weather.

The review particularly called out "CANCELLED!" — a song about fame — as tone-deaf, and "Actually Romantic," which appears to mock Charli XCX, as "real playground bully type shit."

The consensus: "Taylor's music worked when she was punching up, but there is nobody left for her to punch up to."

Even die-hard fans are being tested, CNN notes, from "absolutely mercenary levels of multiple and expensive versions of physical media" to songs about Travis Kelce that come off flat in the era of Sabrina Carpenter.

The AI controversy…

Swift also faces backlash over allegedly using AI to promote the album. Her treasure-hunt promotion featuring QR codes unlocked videos with telltale AI artifacts: blurred images, missing letters, body parts that don't line up.

It’s ironic because Swift has publicly spoken against AI deepfakes and AI replacing human creativity.

"For someone who has made a big deal about how artists aren't paid appropriately... this is tone deaf AF," one Reddit user wrote.

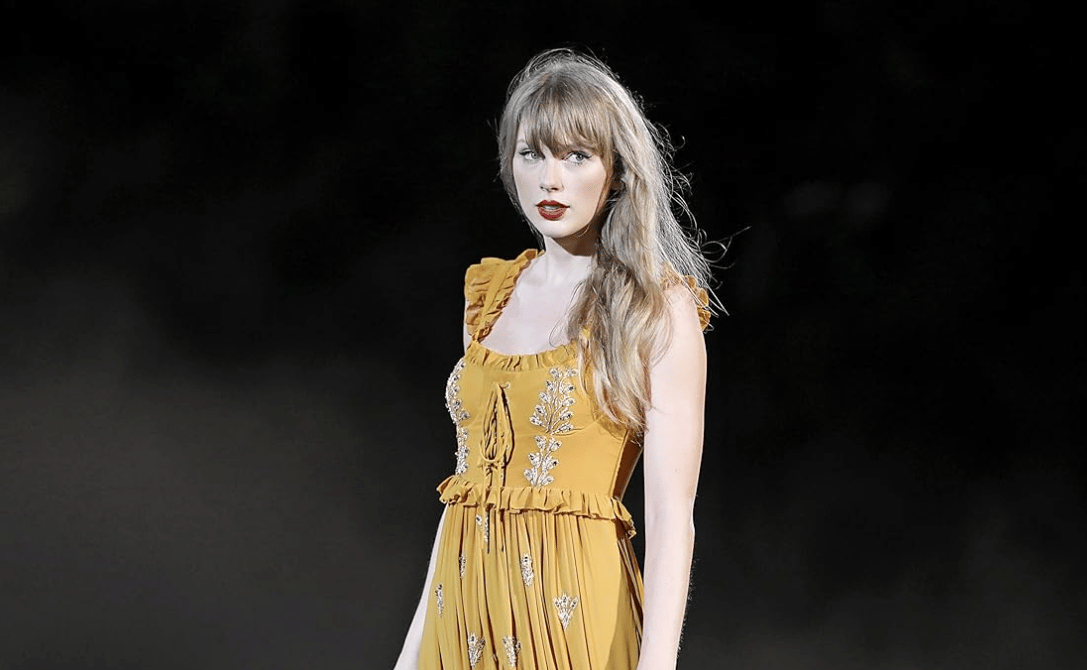

Here’s how she built her empire…

Source: Octavio Jones/TAS23/Getty Images for for TAS Rights - © 2023 TASRM and Getty Images

Swift's wealth breaks down as follows, per Forbes:

The Eras Tour: $2.2 billion in North American ticket sales alone, with over 10 million attendees. The tour became the highest-grossing of all time.

Music catalog: Worth an estimated $600 million. In May 2025, she bought back her original masters from Shamrock Capital for approximately $360 million, giving her full ownership of her life's work for the first time.

Real estate: $110 million in properties across Nashville, LA, Rhode Island, and New York City's Tribeca.

Concert films: The Eras Tour movie grossed $261 million worldwide, with Swift receiving half the box office earnings after bypassing studios to self-fund it. She later sold streaming rights to Disney+ for over $75 million.

Merchandise and vinyl: Swift is the undisputed queen of vinyl — one in every 15 vinyls sold in the US is hers. "The Life of a Showgirl" sold 1.2 million vinyl copies in its first week, surpassing the artist’s own previous record.

Bloomberg notes that Swift's fortune is "largely based on cash, which we assume she's mostly invested, probably well, with help from her dad, a Merrill Lynch financial adviser."

Swift's sales are particularly impressive given industry-wide decline.

In the UK, only Sam Fender's "People Watching" has sold more than 100,000 copies in a week this year. Ed Sheeran's latest moved just 67,000 units.

Yet despite record-breaking numbers, Swift herself laughed off retirement rumors on BBC Radio 2: "That's a shockingly offensive thing to say. It's not why people get married—so that they can quit their job."

The tension is palpable: Swift has never been more commercially successful or culturally dominant.

But the artistic goodwill she built with "Folklore" feels increasingly distant, and even loyal Swifties are asking what happened.

At $2.1 billion, Swift has achieved something unprecedented in music. Whether her art can keep pace with her business empire remains the uncomfortable question critics—and fans—are now asking out loud.

Sources: BBC, Euronews, CNN, CNBC, Business Insider, Bloomberg, The Alternative, Fox Business

That’s all for today!