Hi there,

Welcome to FinSoar. The Bank of America released a report on childcare costs, food aid distribution is facing large-scale disruption, and Disney might be in trouble:

Child care is now a macro variable (and New Mexico just stress-tested one fix)

U.S. child-care inflation is running at 5.2% year over year, roughly 1.5× headline CPI, and it’s changing household budgets, labor supply, and regional spending patterns.

Bank of America card data show the number of households making monthly child-care payments fell 1.6% in September, even as the average payment rose 3.6%.

Costs are diverging by region, with New England up 6.6% and the West North Central up 8.2%.

Among cities, Nashville is running 6%+ above 2024 averages.

For lower-income families who still pay, discretionary card spending has flattened while middle- and higher-income households keep spending, a sign that fees are crowding out other outlays.

Those price dynamics are pushing work decisions. Bank of America’s payroll linkage shows fewer dual-paycheck households among those paying for care, with the drop most acute at lower incomes.

Women’s labor-force participation has drifted down in recent months while men’s edged higher, and the number of women citing family duties for being out of the labor force is rising again.

Daycare for one child now exceeds monthly rent for many families, pushing some parents to cut hours or exit jobs altogether, with clear spillovers to savings and consumption.

The household-level strain is visible on the ground: one Texas family told CBS News their child-care bill is $100 more than their mortgage, and waitlists and capacity constraints compound the pain.

Policy responses are diverging.

New Mexico just launched the first universal, free child-care program in the U.S., funded mainly by investment income from a $10 billion early-education endowment built on oil and gas taxes.

Vouchers cover public and private providers up to age 13; reimbursement rates rise for centers that pay at least $18/hour and offer full-time care. Families like a Taos teacher’s expect to save about $12,000 a year. The state still needs ~14,000 new slots and ~5,000 educators, and critics prefer a stay-at-home tax credit option.

Elsewhere, the trend is tightening, not loosening. With pandemic stabilization dollars spent, some states froze new subsidy enrollments.

In Denver, one center reported open seats it can’t fill because families lack vouchers; waitlists and closures are appearing in other states too, and advocates warn flat federal funding will create more inaccessibility.

Add in rising financial stress for parents and a policy patchwork, and child care has become a key input into both labor-force participation and consumer spending—not just a line item on the monthly budget.

Sources: The Guardian, Bank of America, Fortune, Barron’s, Reuters, BBC, CBS

Food aid in freefall: how SNAP’s lapse turned into a national stress test

The U.S. food safety net is facing its first large-scale disruption in six decades.

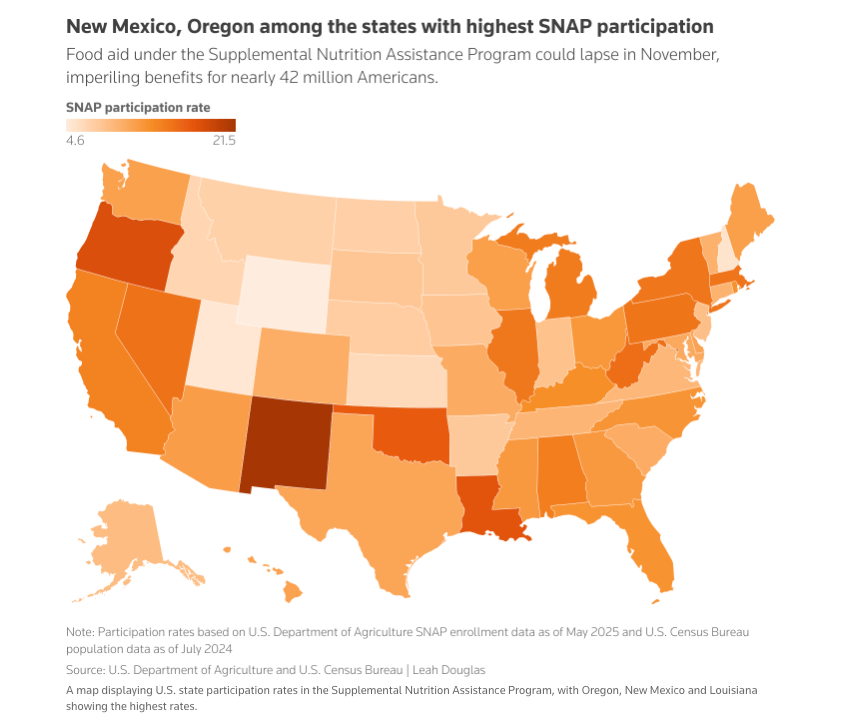

The Supplemental Nutrition Assistance Program (SNAP), which supports about 42 million people, or roughly 1 in 8 Americans, ran out of funding in early November as the federal government shutdown dragged into its fifth week.

The $8 billion-per-month program provides essential grocery support, covering about 63% of participants’ food budgets, according to the Agriculture Department (Washington Post).

Two federal judges ordered the Trump administration to use contingency reserves to keep the program alive, calling the suspension “unlawful.”

The White House agreed to unlock about $5 billion, roughly half the needed funds.

That means recipients will receive 50% of their normal monthly benefits, with payments likely delayed “anywhere from a few weeks to several months,” according to government filings.

SNAP accounts for about 9% of all U.S. grocery spending, making it a stabilizer for retailers, farmers, and food producers.

Even short disruptions pull billions out of local economies. States like Virginia, Delaware, and Louisiana declared emergencies and dipped into surpluses or reserve funds to issue partial payments, but most states said they either lacked the money or the technical systems to distribute benefits without federal help.

Food banks are being forced into triage.

Normally, SNAP provides nine meals for every one meal served by food banks, according to Feeding America. Now those networks are seeing demand spike overnight.

In California and Texas, some food banks have shifted operations into stadium parking lots to manage the surge, while others, like the Capital Area Food Bank in Washington, warn they can only meet 20% of the region’s need.

Political blame is circulating as quickly as food donations.

The administration blames Senate Democrats for blocking spending bills, while Democrats argue the USDA failed to use its emergency powers sooner.

The humanitarian math, however, is nonpartisan: for the first time since the Great Depression, the U.S. is testing what happens when its core food-aid pipeline shuts off, one meal card at a time.

Sources: Washington Post, Guardian, Al Jazeera, Reuters, BBC, NPR

Disney’s latest blackout shows the limits of streaming leverage

The fight between Disney and YouTube TV has blacked out ESPN, ABC, FX, and more than 20 other channels for roughly 10 million subscribers, cutting off marquee broadcasts like College GameDay and Monday Night Football.

The two companies are sparring over carriage fees — the payments distributors make to carry a media company’s channels — and both are betting that public pressure will force the other’s hand.

Disney says Google’s YouTube TV refuses to pay “fair market rates” and is using its market dominance to undercut competitors like Hulu + Live TV, which Disney owns.

YouTube counters that Disney’s terms would raise prices for customers and advantage its own bundles.

In an internal memo, Disney executives said YouTube “is not interested in achieving a fair deal,” while YouTube offered a $20 credit to affected customers and publicly declined Disney’s request to briefly restore ABC for election coverage, calling it a “confusing one-day stunt.”

This latest clash underscores how streaming has inherited and intensified the problems of cable.

Sports rights have become the most expensive content on TV, with the NBA’s new $76 billion deal setting a new benchmark.

Services like YouTube TV and Fubo were supposed to be cheaper alternatives to cable, but carriage inflation and fragmented exclusivity mean consumers are now paying more across multiple apps.

Searches for “cancel YouTube TV” hit a five-year high last week, while interest in Fubo and Hulu + Live TV spiked to multiyear peaks.

For Disney, which is transitioning ESPN into a standalone streaming product at $29.99 per month, this fight is both an earnings negotiation and a test of brand loyalty.

For YouTube, it’s a positioning play against a rival content giant that also competes for advertising and subscription dollars.

But the real loser may be the streaming consumer, stuck in the middle of a reshuffled market that increasingly resembles the old one, just with higher prices and fewer channels to watch it on.

Sources: Business Insider; CNET, Reuters; YouTube Blog; Forbes, The News Digital

That’s all for today!