Hi there,

Welcome to FinSoar! This week, tech infrastructure proved fragile, job markets are sending mixed signals, and even beef prices have become geopolitical:

Amazon Sneezes, and the Internet Catches a Cold…Call the Doctor

Monday morning brought an unwelcome reminder of how much of the internet runs on Amazon's servers. Amazon Web Services experienced a massive outage starting at 07:11 GMT, disrupting 113 services and taking down apps, websites, and online tools used by millions worldwide.

The culprit was a technical update to DynamoDB's API that caused DNS problems in AWS's main Virginia data center. Think of DNS as the internet's phone book; it translates website names into the numeric addresses computers need to connect. When DynamoDB went down, other AWS services began failing like dominoes.

The casualty list read like a who's who of the internet. Downdetector showed user reports of problems at sites including:

Hospitals said crucial communications weren't working, teachers couldn't access lesson plans, and Ring cameras stopped functioning. Even Alexa was speechless.

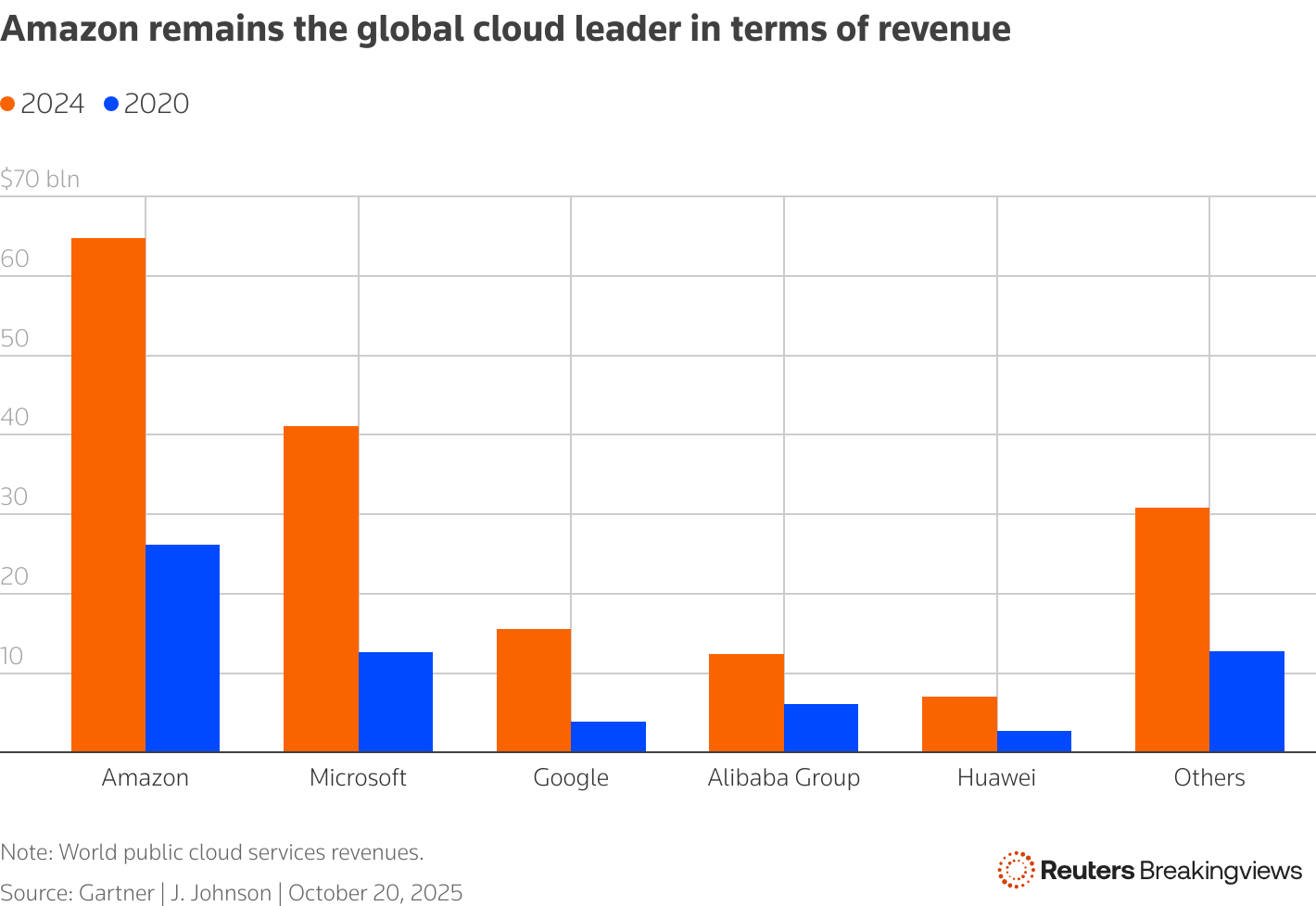

AWS accounts for around a third of the cloud infrastructure market, ahead of Microsoft and Google, which explains the widespread chaos. One expert estimated the total impact will reach billions of dollars, while Downdetector recorded over 11 million reports from users, with more than 2,000 companies affected worldwide.

"We urgently need diversification in cloud computing," said Dr. Corinne Cath-Speth from digital rights group Article 19. "The infrastructure underpinning democratic discourse, independent journalism, and secure communications cannot be dependent on a handful of companies."

Amazon reported all services returned to normal by 6:01 PM ET, but the episode joins a growing list of major outages, from CrowdStrike's Windows chaos in July 2024 to previous AWS disruptions in 2021 and 2023.

As one analyst put it: "It's almost akin to putting all of your economic eggs in one basket."

For investors, Amazon's stock held up relatively well.

The company's dominance means customers can't easily jump ship, because their businesses are too deeply integrated. If you didn’t believe it before, believe it now: When a handful of tech giants control critical infrastructure, single points of failure become everyone's problem.

Sources: Al Jazeera, CNBC, The Guardian, Business Insider, CNN, Wired

The Job Market's Mixed Signals Are Getting Expensive

The job market is sending conflicting messages, and neither employers nor job seekers seem happy about it.

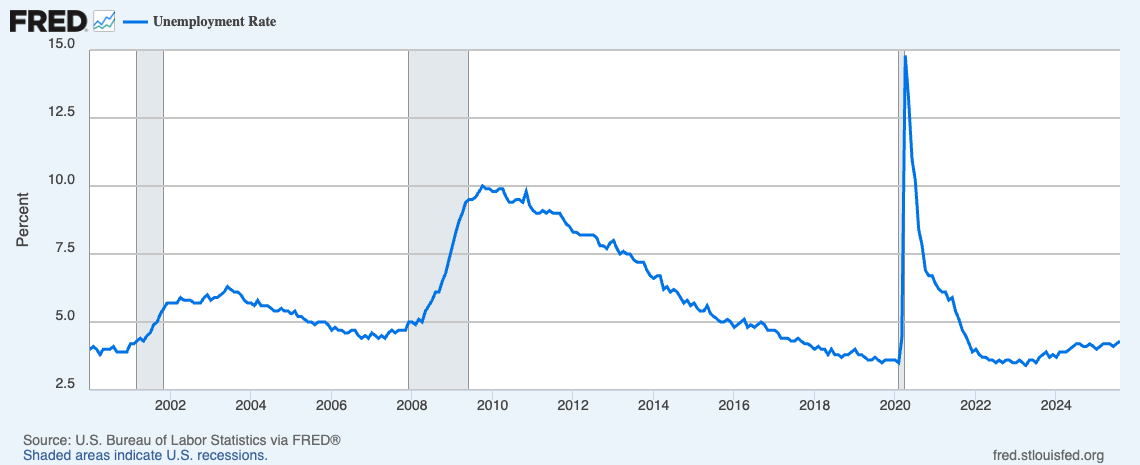

Goldman Sachs chief economist Jan Hatzius warned that GDP estimates showing 3.8% growth in Q2 and 3.3% in Q3 may be "overly optimistic" due to weakening employment trends that offer "more reliable information about current growth than preliminary GDP estimates."

Americans filing for unemployment benefits hit 263,000 in early September, the highest level since October 2021, nearly 30,000 higher than economists predicted.

An AP-NORC poll found 47% of adults aren't confident they could find a good job if they wanted to, up from 37% in October 2023.

Meanwhile, Trump refuses to release September's jobs report, ostensibly due to the government shutdown.

But as former BLS commissioner Erica Goshen noted, the report was "almost certainly prepared and ready to go" before the shutdown began.

Job seekers are spending thousands on premium LinkedIn subscriptions, AI resume tools, and career coaches, with one North Carolina applicant estimating $6,000 in job-hunting costs.

AI headshots are booming as candidates seek professional-looking photos for under $50, though recruiters warn against looking "inauthentic."

Google's Sergey Brin suggested 60 hours as the "sweet spot" for productivity, while Cerebras's CEO recommended "every waking minute" for entrepreneurs.

Experts called both suggestions unsustainable, though they acknowledged Gen Z workers may need to exceed 40 hours early in their careers to advance.

The disconnect between rosy GDP figures and job market reality suggests the economy's foundation may be shakier than headline numbers indicate.

When people are spending thousands just to get interviews, something fundamental has shifted in America's employment landscape.

Goldman Sachs warned that positive GDP numbers may be masking underlying job market weakness, while job seekers are spending thousands on tools just to get interviews. Which statement best describes your current view of the job market?

What's your take? Are you seeing a hiring freeze in your industry, or is business as usual? If you're job hunting, what's the strangest expense you've had to cover?

Trump's Beef with Beef Prices Gets Complicated

Trump announced Sunday that America could buy Argentine beef to bring down domestic prices, calling Argentina "a very good ally" while his own cattle producers called it a betrayal.

US cattle farmers criticized the suggestion as a threat to their livelihoods, especially since they're currently profiting from sky-high livestock prices.

"This plan only creates chaos at a critical time of the year for American cattle producers, while doing nothing to lower grocery store prices," said Colin Woodall, CEO of the National Cattlemen's Beef Association.

Argentina currently represents about 2% of total US beef imports, far behind Australia, Brazil, and Canada.

Economists say increased imports from Argentina are unlikely to meaningfully reduce US beef prices.

"The US cannot buy enough beef from Argentina to materially move the needle in the market," Steiner Consulting Group noted.

Meanwhile, Trump's broader trade policies have farmers in crisis mode. China has made no soybean purchases from American farmers this year amid the ongoing trade war, leaving growers like Scott Gaffner watching his 600 acres of soybeans pile up in silos.

"We don't want the aid, we want the trade," Gaffner told CBS.

Farm bankruptcies were up 56% in the 12 months ending in June, with more than half of US farms losing money according to the American Farm Bureau Federation.

US cattle inventories dropped to their lowest level in nearly 75 years after ranchers slashed herds due to drought.

The Argentina plan adds insult to injury. Trump's $20 billion currency swap lifeline to Argentina comes as the South American nation sells soybeans to China.

These are crops that used to come from America. "The last thing we need is to reward them by importing more of their beef," said Rob Larew of the National Farmers Union.

Despite the financial pain, polling shows Trump remains popular in rural areas, though patience appears to be wearing thin.

As one farmer put it: "We're giving him a chance — there'd better be results."

That’s all for today!