Hi there,

Welcome to FinSoar, the sea of information for smooth sailing across the world of finance!

Three stories caught my attention this week, and they all point to the same thing: the old rules aren’t working anymore. Gold’s rallying like it’s 2008. ChatGPT wants to become your personal shopper (and Google’s not amused). And nearly 9 million Americans are working multiple jobs for an extra $1,000 a year.

Gold Rush 2025: Why the “Boring” Safe Haven is Suddenly Exciting

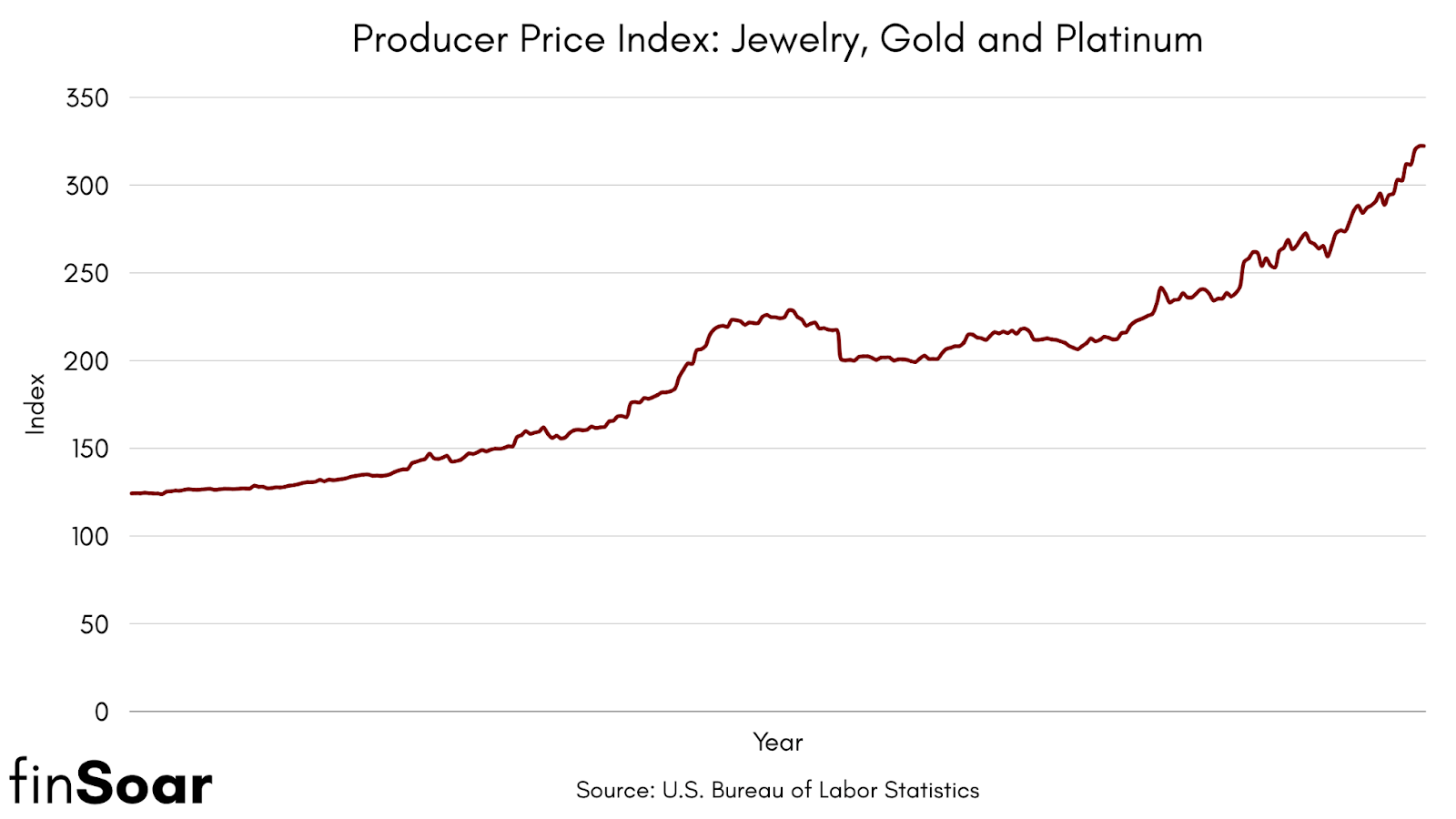

Gold just hit record highs for the seventh straight week. Here's why the "boring" asset is suddenly exciting. Let’s look at the numbers:

Gold hit $3,896.49 on Thursday — a record high and its seventh consecutive weekly gain. The metal has surged 47% year-to-date, meaning a January investment would be worth nearly 1.5x by October.

UBS expects gold to hit $4,200 in the coming months, while Goldman Sachs forecasts a 6% rise by mid-2026.

The broader precious metals rally: Silver at $47.81, platinum at $1,601, palladium at $1,266 — all posting significant gains.

But what’s driving it?

The US government entered its third day of shutdown with no resolution in sight. The shutdown postponed key economic data releases, including the jobs report, leaving investors flying blind and seeking safety.

"The longer the government stays shut down, that's going to be a steady bullish element for the gold market," Kitco Metals analyst Jim Wyckoff told Reuters.

Investors price in a 98% probability of a 25-basis-point rate cut in October and 90% odds of another in December, per CME's FedWatch tool.

Lower rates make gold more attractive since it eliminates the opportunity cost of holding non-yielding assets. UBS notes: "The opportunity cost of holding gold is falling thanks to declining real interest rates in the U.S., while expectations of further broad U.S. dollar weakness are another tailwind."

Despite the postponed jobs report, alternative indicators suggest labor market softening — which typically prompts more rate cuts, further boosting gold.

Here’s the weird part: Gold and stocks are simultaneously setting records — an unusual dynamic. Typically, gold rallies when investors flee stocks.

Gold is often used as a safe store of value during political and financial uncertainty. A 5-10% allocation can reduce portfolio volatility, though gold generates no cash flow or dividends — just price appreciation.

When gold rallies this hard, institutional investors like central banks, hedge funds, family offices are hedging tail risks. They're not panicking, but they're not complacent either.

At nearly $3,900 per ounce, gold is expensive by historical standards. If the shutdown resolves quickly or inflation proves stickier than expected (pausing Fed cuts), gold could reverse rapidly.

The rally has been driven by sentiment rather than physical demand from jewelry or industrial users.

Gold's 47% surge reflects a market grappling with government dysfunction, dovish monetary policy, and persistent uncertainty. Whether it hits $4,200 as UBS predicts or consolidates here, in an environment of political chaos and falling rates, the oldest safe haven is having its moment.

Sources: Reuters, Economic Times, Business Insider, Goldman Sachs, Fortune

ChatGPT Can Buy Stuff Now and Google Should Be Worried

I tried to find a retirement gift using ChatGPT

OpenAI just turned 700 million weekly users into potential shoppers without leaving the chat!

OpenAI launched Instant Checkout on Monday, letting users buy products directly through ChatGPT. U.S. Etsy sellers are live now, with over 1 million Shopify merchants, including Glossier, SKIMS, and Spanx, coming soon.

The feature uses the Agentic Commerce Protocol, co-developed with Stripe and now open-sourced, so any AI platform — Claude, Gemini, TikTok's AI — can adopt it.

Merchants pay OpenAI an undisclosed fee per transaction, creating a new revenue stream beyond subscriptions.

The market reacted: Etsy jumped 16%, Shopify climbed 6%.

Here’s how it works:

Ask ChatGPT "best running shoes under $100" and it shows relevant products. If Instant Checkout is enabled, tap "Buy," confirm details, and done. The merchant handles everything — ChatGPT just connects the dots.

Currently, results are "organic and unsponsored, ranked purely on relevance" — no paid placements. Yet.

For decades, online shopping meant: search, scroll, cart, checkout. Google made billions by inserting itself at the search step. ChatGPT just collapsed that entire funnel into a conversation: ask and buy.

"ChatGPT users are already running over a billion web searches per week," and a huge portion are shopping-related. Converting even a fraction into purchases would be massive.

SEO is dead. AIO is here. Brands are now feeding ChatGPT "product feeds"— structured catalogs with prices and availability — to improve their chances of being recommended. Some supply more detail than they publish on their own sites.

Welcome to AI Optimization, where the goal is to make sure ChatGPT understands your product, taking Google’s algorithm out of the picture.

However, this also means brands lose control: The AI decides what to recommend based on availability, price, quality, and whether a merchant is the primary seller. Your carefully designed website? Irrelevant. The "storefront" is now ChatGPT's interface.

Here are some questions I’m asking:

How long until paid placements? Right now results aren't ads. But when billions in revenue are at stake, how long until "sponsored recommendations" appear?

What about publishers? When asked how affiliate revenue will work when ChatGPT recommends products based on reviews from sites like WIRED, OpenAI said it's "experimenting" with no specifics.

Publishers who built review businesses through affiliate commissions are watching nervously.

Why open-source it? OpenAI says it's "net-beneficial" if merchants have less integration work. This is my cynical take: they want to set the standard before Google and Amazon build their own.

OpenAI expects $125 billion in revenue by 2029, up from under $4 billion last year. E-commerce fees alone won't get them there, but it positions ChatGPT as more than a chatbot — it's becoming an interface layer between consumers and the economy.

For consumers, it's frictionless convenience. For merchants, it's 700 million potential customers. For Google, it's an existential threat to their $200+ billion search advertising empire.

The Side Hustle Nation: Why 9 Million Americans Are Working Multiple Jobs

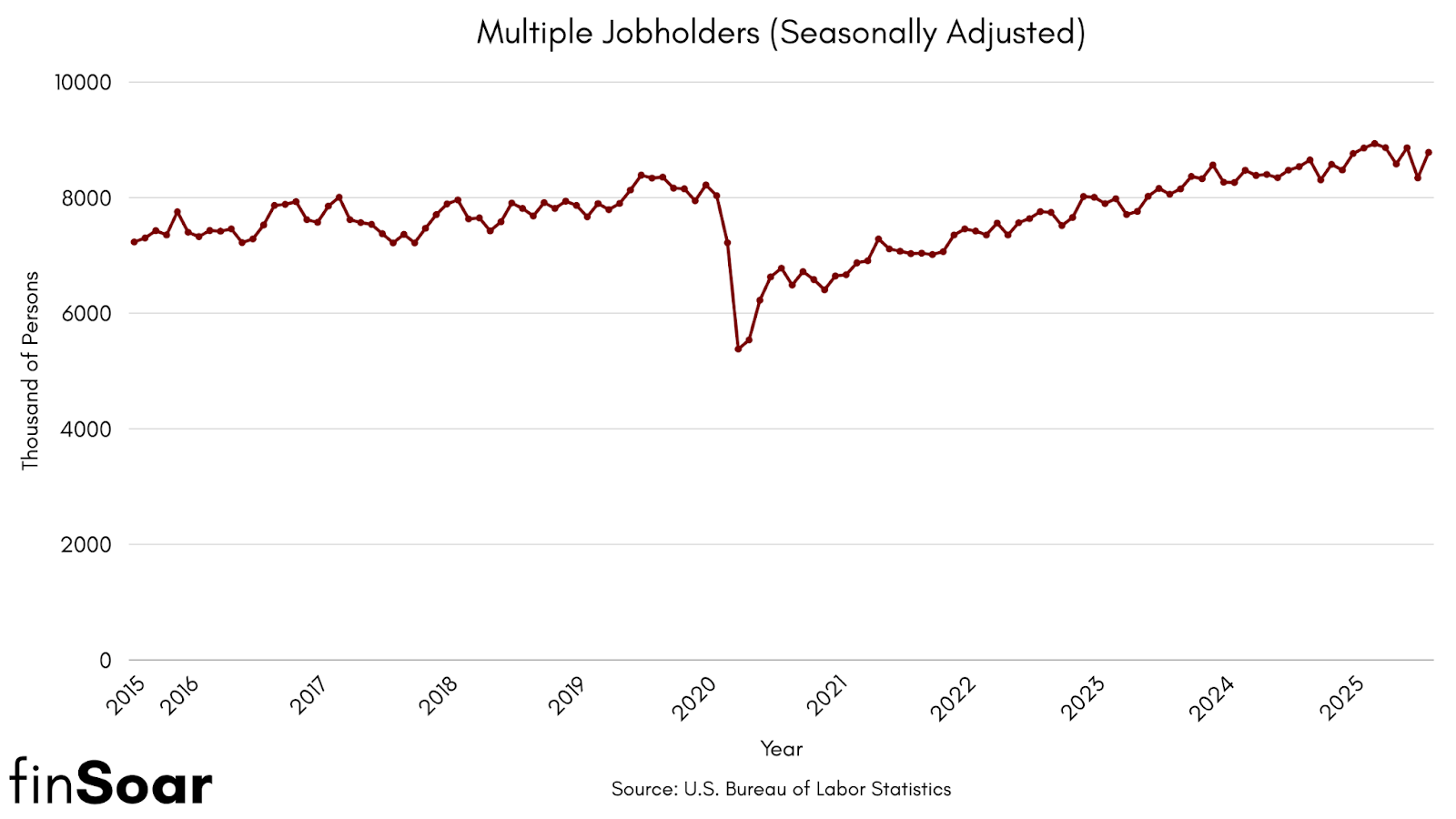

A record number of workers are juggling multiple paychecks — but the math might surprise you:

A staggering 8.9 million Americans now work multiple jobs — the highest number since tracking began in 1994. That's 5.4% of all employed workers, a rate not seen since the Great Recession.

But here's the kicker: Multiple jobholders earn only about $1,000 more annually than single-job workers ($57,865 vs. $56,965). That's barely $83 a month for potentially double the stress.

The share of multiple jobholders with college degrees hit 50.2% in 2024, up from 45.1% in 2019, according to the Federal Reserve Bank of St. Louis.

Gen Z is leading the charge. A study found 93% of Gen Z workers split time between multiple employers, compared to just 28% of baby boomers and 23% of Gen Xers. Some are even more extreme: One Reddit user claims five concurrent jobs bringing in over $3,000 per day.

But why now?

Prices for essentials like food, shelter, and energy rose 2.8% in February, while wages haven't kept pace. The average workweek dropped to 34.1 hours in February, down from 34.3 hours a year earlier — forcing workers to patch together income from multiple sources.

The pandemic normalized working from home, eliminating commutes and making it feasible to toggle between employers. 35% of multiple jobholders now do telework, according to a Washington Post analysis.

About 64% of workers holding multiple full-time jobs use AI tools to summarize documents, respond to emails, and generate reports — making the impossible suddenly manageable..

26% of polyworkers report that their side hustles negatively impact personal relationships, so it’s not without setbacks.

While there's no federal law prohibiting multiple jobs, there are still some consequences:. Workers have been exposed through LinkedIn activity, tax records, background checks, and accidentally showing up on Zoom calls for competing jobs.

Most employment contracts include clauses requiring employees to devote their "whole time and attention" to work. If you're caught working for a competitor or sharing confidential information, you could face termination or even legal liability.

As ZipRecruiter's chief economist, Julia Pollak notes: "If employers are seeing soft demand for labor and cutting hours, that's another reason why people are taking on additional jobs to fill the week and their bank accounts."

For Gen Z, it's become normalized. "The new 'dream job' is actually a corporate and side-hustle balance," says Gianluca Russo, who juggles a full-time LinkedIn job with teaching indoor cycling, choreographing dance, and freelance writing.

But when asked if it's worth it, the answer depends on who you ask — and whether you're willing to trade sleep, relationships, and health for an extra $1,000 a year.

Sources: Forbes, The Washington Post, CNBC, Fortune, Harper's Bazaar

That’s all for today!